The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Vacation, the “leisure” beauty brand, likes to be known for one thing: making sun care fun.

Since soft-launching direct-to-consumer in April 2021 — first targeting the listeners of always-on internet radio station Poolside FM — the line has committed to that philosophy with sunscreen that looks like Reddi Wip, oils that smell like Chardonnay, retro-inspired collaborations with tennis brand Prince and ads that ooze Club Med.

Despite offering a chance to revel in 1980s excess decades later, the brand is no gimmick. In December 2022, the brand secured a $6 million Series A capital raise, led by Silas Capital, bringing the brand’s total fundraising to $11.2 million.

Now, Vacation is ready for a bigger, broader audience.

ADVERTISEMENT

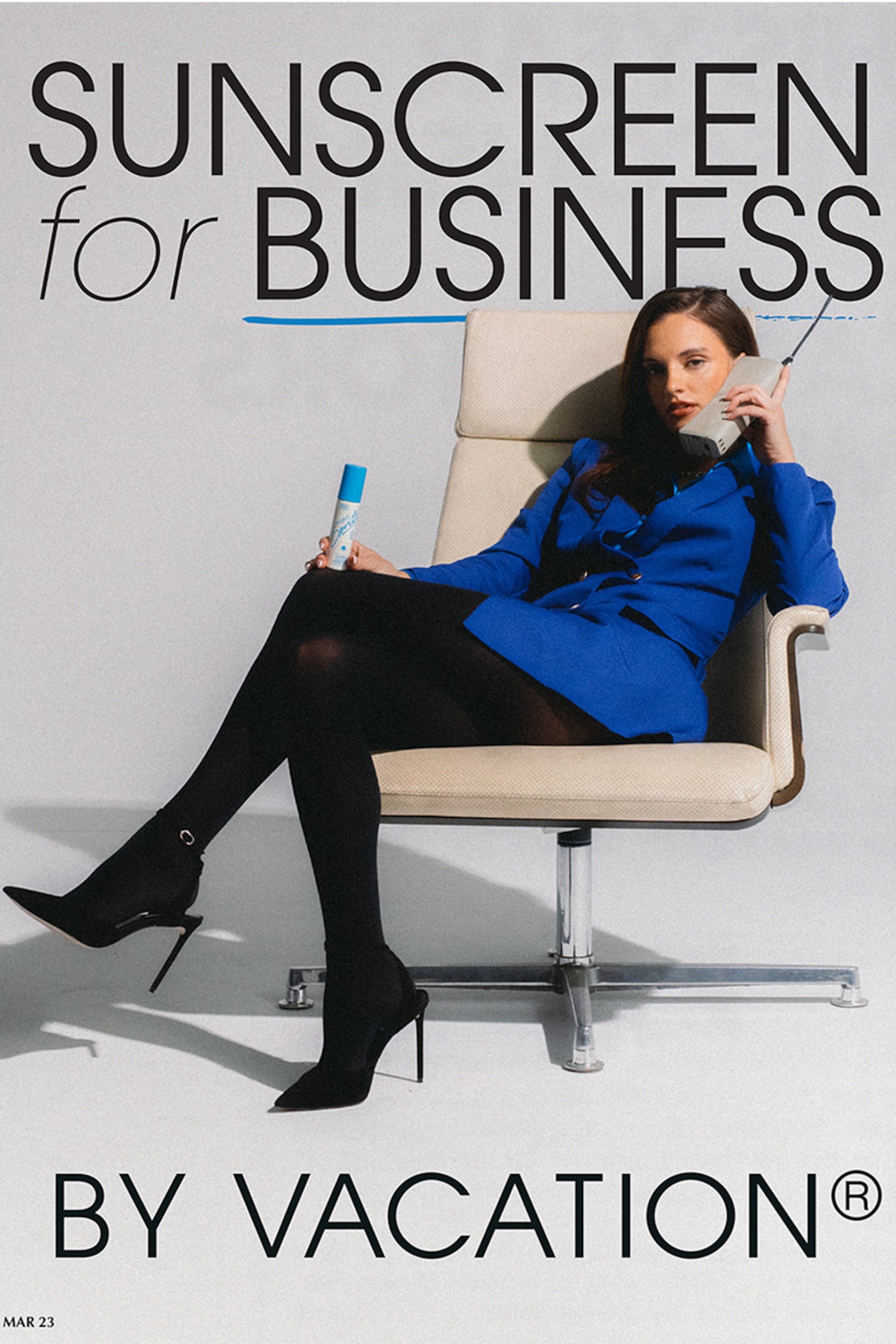

This month, the brand expands to 700 more Ulta Beauty locations, its largest national partner, bringing its total door count to 1,200-plus stores. It’s growing its product assortment in tandem: last week Vacation launched its Super Spritz SPF 50 face mist, the label’s first daily product meant to take customers from the “beach to the boardroom and vice versa,” said founding partner Lach Hall; in April, it will its introduce an After Sun Gel.

Though Vacation initially attracted attention for its insider, cool kid club vibe — the brand created fictional roles and business cards for fans like “head chair of the Jimmy Buffett excellence committee” and sold NFTs at Art Basel — 85 percent of sales come from shoppers in non-coastal cities. 60 percent of customers are under 44 and the remaining 40 percent are over 45.

“When we launched … our community was 100,000 people who were design driven, trendy and in coastal areas. But within the first year, when we started to see our marketing, PR machine kick off, we started appealing to people across the country,” said Hall. “That’s really the mission that we are on.”

Created by two former advertising executives, Hall and Dakota Green, and Poolsuite Suite founder Marty Bell, Vacation arrived as a novel, bright spot in the sun care market in 2021. It positioned itself far away from the more clinical sunscreens found in Sephora like Supergoop!, while maintaining equal distance from mass family lines like Banana Boat, Coppertone and Hawaiian Tropic.

Green said the brand is not out to “fearmonger” consumers into buying from Vacation, but rather make sunscreen a lighthearted and easy experience. Case in point: its Classic Whip SPF 30, which launched in December 2022, was made as a mousse formula with a tilt valve actuator to mimic the dessert topper. Since its offseason launch, the product has sold out twice.

Though Vacation does sometimes initiate paid influencer campaigns, the social media traction around its Whip product was organic. A video of TikToker Athena Layna trying Classic Whip has 15.2 million views; another with Golloria George has 3.4 million views. More broadly, Vacation has had over 50 million views on videos featuring its products on TikTok in the last two months, though the brand has just 4,400 followers on the platform.

“The fragrance, textures and branding are all about getting more people to use sunscreen, and make it enjoyable. We see marketing as a way to extend our word of mouth,” said Green.

Brian Thorne, partner at Silas Capital, which has invested in other beauty brands including Ilia and Makeup by Mario, argued that Vacation’s creative products and virality makes up for the “digital marketing inefficiency in a post iOS14 social media landscape.”

ADVERTISEMENT

Potential customers, too, are caught by surprise by Vacation’s products. Carl Kah, an Austin-based sales executive, who recently stumbled on Vacation at a resort in Breckenridge, Colorado, first thought its mousse sunscreen was a dessert garnish.

“When you see what looks like whip cream in a ski store at the register it stands out,” said Kah, who shared the brand on his Instagram Stories. “It doesn’t belong there. You notice it even if you aren’t looking for sunscreen.”

With its innovative, fun-filled approach to product development and brand positioning, Vacation believes it can be just as successful if not more than its competitors. According to Green, the brand expects to hit $20 million in retail sales by the end of the year.

To get there, it’ll need to extend its reach. Just a year after landing in Ulta Beauty, the brand is nearly doubling its door count. In April, Vacation will be debuting a “mini-bar” gondola in stores, complete with 10 products like its new Super Spritz face mist and Vacation Eau de Toilette, developed by Arquiste founder Carlos Huber and Rodrigo Flores-Roux of fragrance house Givaudan. It smells like coconut, banana, pineapple, with notes of “pool water and swimsuit lycra.” The brand’s wholesale mix is varied: beyond Ulta, it’s also sold at The Standard hotels, Kith and Nordstrom, among other local destinations.

Lisa Tamburello, Ulta Beauty divisional merchandise manager of skincare said Vacation is unlike any other brand it carries.

“It’s not the clinical approach, where someone is saying, ‘I have to have this product to fight cancer.’ They are doing that, of course, but they are bringing top-of-the-line scents and innovation,” she said.

She noted that line has resonated with young Millennials and Gen-Z, as well as multi-racial shoppers, consumers who self identify as two or more races and who Tamburello described as the beauty shopper of the future.” Price points are also sharp; Vacation’s Classic Lotion is $18; lip balms sell for $5.

Tamburello hopes The Super Spritz face mist will capture the consumer Vacation is not getting, i.e. true beauty consumers, who have gotten used to adding SPF to their morning makeup routines.

ADVERTISEMENT

Hall is eyeing expansion to another national retailer by the end of 2023. The brand hired London Nielsen Krupski in November 2022 as SVP of sales and commercial strategy; a former Bondi Sands executive, who facilitated the line’s expansion into Ulta Beauty, Walmart and Target.

“It’s our long term mission to be in all the places [where] you buy sunscreen,” said Hall. “The method to our madness is creating weird and wonderful and wild sunscreen products, so that when someone is walking past the sunscreen aisle it creates a bit of a WTF moment so people stop and say, ‘What is this?’”

Editor’s Note: This article was amended on Mar. 20. 2022, to clarify Flores-Roux’s title and to reflect that Vacation does engage in paid partnerships.

Black founders carry a markedly higher burden when it comes to educating investors on the value and viability of their business ideas — but there is an art and science behind knowing when your brand is ready and what kind of investors will be the best fit.

Landing a retail partnership is often seen as a major milestone for beauty founders — but it brings a bevy of new challenges, from the logistical complexities to setting a marketing budget. Black entrepreneurs, who typically have far less capital to work with, often face tough choices.

The firm has been working on a listing since at least 2022, with previous attempts buffeted by volatile markets.

In a three-part series, The Business of Beauty explores how Black founders Monique Rodriguez, Danessa Myricks and more built, launched and scaled their multi-million-dollar businesses. In part one, a look at how these entrepreneurs found their niche and harnessed early lessons that were critical to their growth