The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

For Gen-Z beauty lovers, a makeup or skin care product that mimics the effect of a more-expensive favourite is almost as coveted as the real thing.

“Now cachet comes from finding the look for less,” said Susan Scafidi, founder of The Fashion Law Institute. “Knowledge of what is ‘just as good’ is the coin of the realm amongst Gen-Z.”

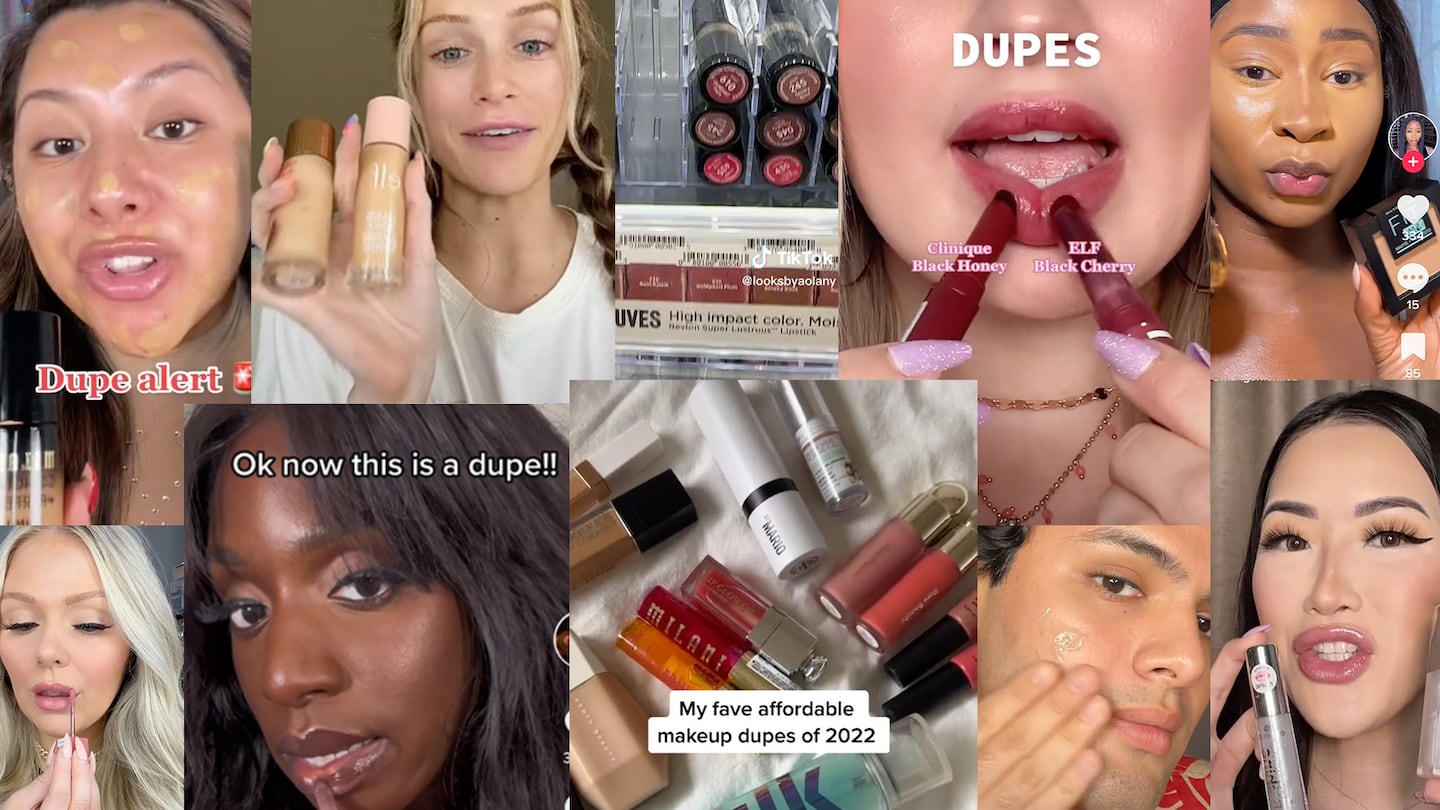

Dupes, or less expensive alternatives to fan-favourite products, are everywhere. On TikTok the hashtag #dupe has nearly 4 billion views. (The Earth’s population, for comparison, is around 8 billion.) In beauty, the concept is especially resonant because products can be indistinguishable both in formula and appearance once they’re applied.

TikTokers, who see dupe videos as a shortcut to virality, are powering the trend. For makeup artist Rose Gallagher, telling people about a good dupe builds online goodwill: “You love being able to help a friend out. It’s like, if your friend is stuck for a tampon, you’re going to give your friend the tampon.”

ADVERTISEMENT

A tough economic climate, rising prices and a lightning-fast trend cycle are creating consumer demand for these more affordable alternatives. Gen-Z’s dupe obsession reveals just how hype-driven the beauty space has become, and raises questions about whether premium and luxury brands are doing enough to reach young consumers.

“Being able to be a fast follower, someone who can come up with a product that’s next to stuff that’s already out there, clearly that’s something that’s growing [in importance],” said Olivia Tong, managing director, senior analyst of consumer at Raymond James.

The explosion of the beauty category set the stage for the dupe craze.

“There’s so many things. New, new, new, new constantly. You really can’t spend hundreds every month on new products,” said Alyssa Lorraine, makeup artist and TikTok creator.

Self-appointed experts on social media help consumers navigate it all. TikTok users hype up prestige names like Charlotte Tilbury, Milk, Dior Beauty, Olaplex and Dyson but also less pricey counterparts like E.l.f., Milani, Essence Beauty and even Shark, which sells a Dyson AirWrap alternative for half the price. Some creators stretch the definition of “dupe” to include items that are vaguely similar to popular products, or even just look alike.

Others lean into expertise, explaining what different products do or don’t, and often abide by a “just use CeraVe” philosophy, giving “dupes” a knowledge-based edge.

“There are so many dermatologists with medical credentials making content saying, ‘This will perform in the same way as that thing you’re coveting,’” said Gallagher.

E.l.f. Beauty is one of the companies that has benefited most from the dupe craze. Its Halo Glow Filter, Power Grip Primer and Hydrating Core Shine, which are similar to Charlotte Tilbury’s Hollywood Flawless Filter, Milk’s Hydro Grip Primer and Clinique’s Black Cherry lipstick, all went viral.

ADVERTISEMENT

On E.l.f.’s first quarter 2023 earnings call in August, chief executive Tarang Amin credited side-by-side comparisons of its products to prestige equivalents with powering the brand to 16 straight quarters of record sales. E.l.f. is stealing market share as consumers trade down, he said.

“They have mastered the art of creating a copycat product at a far lower cost than the alternative. It goes viral, then everyone is trying it out” said Korinne Wolfmeyer, senior equity analyst at investment bank Piper Sandler.

Still, E.l.f. wants to be known as more than a dupe brand. It’s made big investments to steer conversation and expand its audience. Earlier this year, it aired an ad during the Super Bowl and is further expanding into skin care, mass beauty’s top-performing category in 2022, according to market research firm Circana.

“They do all the things that other companies that are looking to [do] … as opposed to just those being a lower cost option,” said Wolfmeyer.

Because “you value what you pay for,” said Lorraine, brands selling super cheap products can be at a disadvantage when it comes to consumer loyalty.

One way to stand out is through content. Essence Beauty, which sells makeup for under $15, has built an online audience with TikTok videos trying out trends and sharing tutorials, said Lorraine. The brand has 2 million followers; Milk Makeup and Charlotte Tilbury both have around 700,000.

The dupe craze isn’t hurting — and may even be helping — prestige beauty. For the most part, consumers traded up rather than down last year: prestige sales reached $27 billion in 2022, up 15 percent from 2021, according to Circana, while mass sales grew 4 percent.

Consistently referencing a product as a holy grail builds buzz and desirability. The much-duped Charlotte Tilbury powered the beauty division of owner Puig to a 52 percent rise in makeup sales in 2022.

ADVERTISEMENT

According to Tong, the dupe effect is doing a combination of things: dupe brands, namely E.l.f., are syphoning off a little bit of demand from prestige alternatives, but they’re also just reaching a whole new consumer.

Middle-market labels will likely be squeezed by dupes, said Tong, and luxury labels that use makeup as an entry point for new consumers could also feel the impact. If accessible brands hook shoppers on their products at low prices, they may not see a reason to trade up or buy into a luxury brand’s other categories.

“You don’t create that positive brand association,” said The Fashion Law Institute’s Scafidi. “It’s a problem for companies that use cosmetics as an introduction to their brand.”

Occasionally, labels litigate when the dupe is a near-exact copy. Charlotte Tilbury won a suit against supermarket chain Aldi in 2019 for promoting a Lacura Broadway Shape and Glow palette with packaging identical to its Filmstar Bronze.

Outside the courtroom, brands with a big budget have an advantage and are developing distinguishable formulas, investing in hard-to-replicate science, patenting specific techniques and leaning into messaging about superior ingredients and traceability, said Scafidi. Brands are also launching lines specifically aimed at Gen-Z: Estée Lauder recently made a bid for young consumers with the launch of Nutritious, an Ulta-exclusive skin-care line.

“[Dupe brands] push the brands to keep innovating,” said Wolfmeyer. “It pushes the category to keep growing.”

Opens in new window

Opens in new windowIndie brands that used to rely on Instagram ads and TikTok influencers to spread the word are hiring traditional sales reps who trek from store to store promoting their wares.

Euphemisms like “pro-aging” and “anti anti-aging” exist to obscure the fact that the beauty industry is selling the same creams and tonics meant to enhance one’s appearance. It may be time for a new approach.

Evan Mock, Harry Styles, Brad Pitt, Jared Leto and many more famous men are banking on the blurring gender binary, or simply the novelty factor, to propel their brands to the top of a crowded market.

Joan Kennedy is Editorial Associate at The Business of Fashion. She is based in New York and covers beauty and marketing.

Black founders carry a markedly higher burden when it comes to educating investors on the value and viability of their business ideas — but there is an art and science behind knowing when your brand is ready and what kind of investors will be the best fit.

Landing a retail partnership is often seen as a major milestone for beauty founders — but it brings a bevy of new challenges, from the logistical complexities to setting a marketing budget. Black entrepreneurs, who typically have far less capital to work with, often face tough choices.

The firm has been working on a listing since at least 2022, with previous attempts buffeted by volatile markets.

In a three-part series, The Business of Beauty explores how Black founders Monique Rodriguez, Danessa Myricks and more built, launched and scaled their multi-million-dollar businesses. In part one, a look at how these entrepreneurs found their niche and harnessed early lessons that were critical to their growth