The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

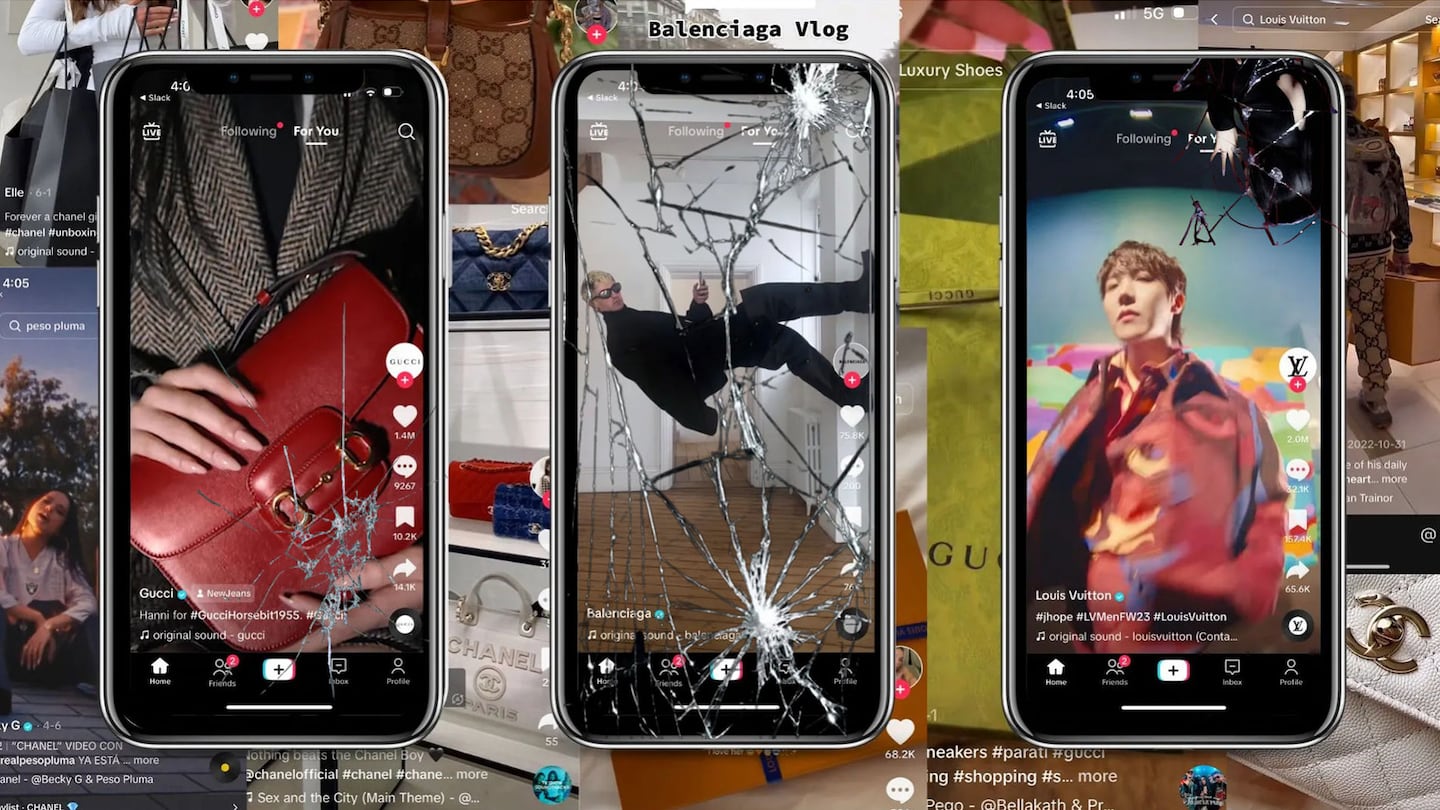

Luxury is officially all-in on TikTok.

High-end brands like Gucci and Dior have operated on the short-form video platform since 2020, if not earlier. But the fashion discourse on TikTok was still dominated by fast-fashion hauls and dupe talk. When luxury brands made waves it wasn’t always in the ways they wanted. For every viral success like Prada’s bucket hat challenge, there was a fiasco like the widely mocked Chanel advent calendars in 2021.

But there are signs more premium brands are finding their footing. In the first half of 2023, luxury brands grew their media impact value, a measure of engagement, on TikTok by 11 percent, outpacing fast fashion’s 7 percent increase, according to Launchmetrics. Dior, Gucci and Prada generated nearly as much MIV in the period from January to May 2023 as they did in all of 2022. Louis Vuitton has already outdone last year’s performance.

“Last year, it was a little bit like, ‘Should we be doing this?’ This year, it’s, ‘How do we do it?’” said Sarah Keeble, luxury marketing director at digital agency Verb Brands.

ADVERTISEMENT

The answer is still to work with influencers, whose content makes up nearly 70 percent of media impact value for top brands. Dior, for example, scored its biggest TikTok hit with content from Jaadiee, a grandfather who does unboxing videos and styles his streetwear to Drake and Gunna tracks. He attended Dior’s Spring/Summer 2024 show in July.

Strategies are evolving though: MIV generated on brands’ own pages grew 4.5 percent year over year, while the share attributed to influencers dropped 8 percent. Louis Vuitton generated a similar amount of MIV across owned and influencer channels, successfully turning big events like Pharrell Williams’ debut men’s show into major TikTok moments. Its top conversation generator so far this year was a brand-produced behind-the-scenes video featuring K-Pop star J-Hope at the June show.

Influencers can grow a brand’s relevance in a space where they weren’t active before. Owned media often better showcases a brand’s tone and can have an insider feel for viewers. That sort of content — where an event or shoot is already happening, and a brand finds a way to stretch it into video content — is also easier to make and cheaper to promote, said Keeble.

K-Pop stars are reliable traffic generators: Campaigns featuring these singers were top performers for Dior, Gucci and Calvin Klein. But it can be hard to predict which content will pop. One of Zara’s top posts on its own account was a video of custom candy being made to celebrate the retailer’s first store in Cambodia.

“The brands that are pushing the boat out and delivering native, human content, that’s who’s really reaping the rewards,” said Keeble. “There are a lot of people doing similar things. How can you do something that’s unexpected?”

Some brands have found success on TikTok while barely having a presence on the platform.

Chanel is the ninth-most discussed brand on TikTok this year, despite never having posted a video to its account. Launchmetrics found the top post for Chanel, which has a TikTok page but has not posted, came from singer Becky G, who was promoting her song named after the brand. Chanel’s second-highest post was a Vogue video of Jennie Kim at the Met Gala.

And an innovative approach to TikTok is no cure-all for a struggling brand. Keeble points to Balenciaga as an example of interesting content production: A person dressed in Balenciaga walks up a wall, or floating Balenciaga products are plucked out of the sky. But the brand’s MIV dropped sharply from $38 million in 2022 to $4.5 million in 2023 — the aftershock of its November advertising controversy.

Instagram has more users, but for a growing number of brands and creators, TikTok has replaced the Meta-owned social network as fashion’s go-to marketing platform.

Joan Kennedy is Editorial Associate at The Business of Fashion. She is based in New York and covers beauty and marketing.

Often left out of the picture in a youth-obsessed industry, selling to Gen-X and Baby Boomer shoppers is more important than ever as their economic power grows.

This month, BoF Careers provides essential sector insights to help PR & communications professionals decode fashion’s creative landscape.

The brand’s scaled-back Revolve Festival points to a new direction in its signature influencer marketing approach.

Brands selling synthetic stones should make their provenance clear in marketing, according to the UK’s Advertising Standards Authority.