The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

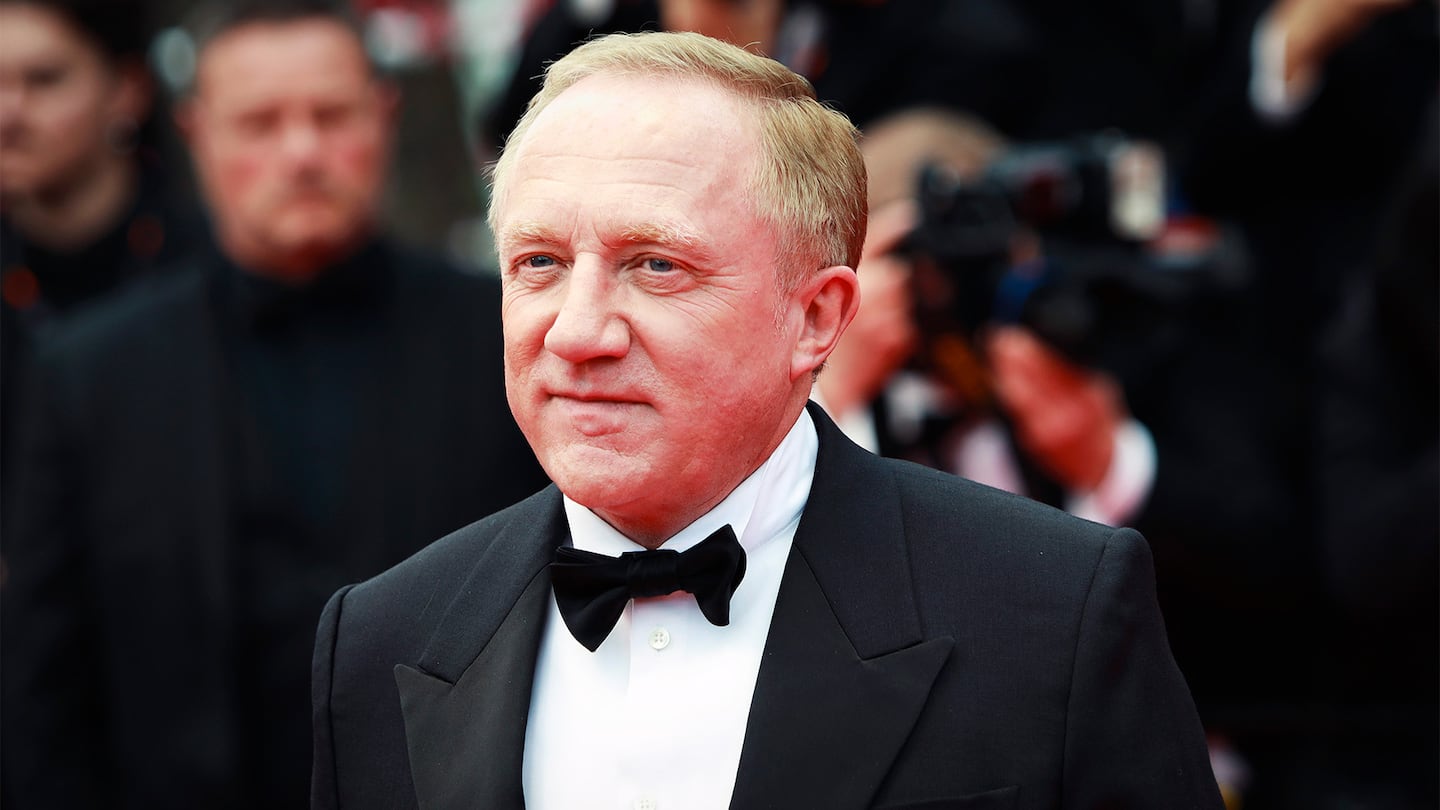

French billionaire Francois-Henri Pinault is close to a $7 billion deal to buy a majority stake in Creative Artists Agency, the Hollywood talent giant that’s home to actor Brad Pitt and basketball’s Chris Paul, according to people familiar with the matter.

Pinault, whose family controls a luxury goods empire, is seeking the majority stake held by private equity firm TPG Inc., said the people, who asked not to be identified because the deal hasn’t been announced. Temasek Holdings Pte, the Singapore government’s investment firm, may also increase its stake in CAA by buying out China’s CMC Capital, the people said. While the deal could fall apart, the parties are expected to conclude negotiations in the next couple of weeks.

The $7 billion valuation of CAA marks an increase from the $5.5 billion placed on the business last year when it acquired rival agency ICM Partners. Pinault, 61, is seeking one of Hollywood’s most stable and powerful institutions at a challenging time for media deals. Valuations of most media companies have slipped due to the collapse of pay TV, rising interest rates and strikes by writers and actors.

Yet the Pinault family sees CAA as a way to invest in the value of celebrities, and may be able to use some of those famous faces to bolster its other businesses. The family is the biggest shareholder in Kering SA, the owner of Gucci and other luxury brands. The Pinaults also control the auction house Christie’s and wineries via a holding company. Pinault’s wife, actress Salma Hayek, is represented by CAA.

ADVERTISEMENT

Founded in 1975 by partners including Michael Ovitz and Ron Meyer, CAA has grown into the largest agency in Hollywood. It’s a top representative of actors, directors, writers, producers, athletes and musicians. Bryan Lourd, Kevin Huvane and Richard Lovett have run the agency since the mid-1990s when they were known as young Turks. All three are expected to remain with the company.

Major Hollywood talent agencies have all raised money over the last decade to expand into new businesses. Endeavor Group Holdings Inc. has been the most aggressive, buying Ultimate Fighting Championship, Professional Bull Riders and, most recently, World Wrestling Entertainment Inc. Its talent agency, WME, now accounts for about a third of sales and profit. United Talent Agency, the third-largest firm, sold a stake to Swedish private equity firm EQT AB last year.

Rumours about CAA’s future have swirled for years because private equity firms don’t typically own companies for years and years. TPG first invested in CAA back in 2010 and acquired a majority stake in 2014. CAA hasn’t expanded as aggressively as Endeavor. It has focused on its core talent representation, as well as corporate consulting. It built one of the largest sports agencies in the world.

As part of the deal, the company may give agents with equity the chance to sell a small portion of their shares, according to the people, and will ask a select number to sign new contracts that will keep them at the firm for the next few years.

By Lucas Shaw and Kamaron Leach

Learn more:

François-Henri Pinault Is in Talks to Buy CAA Talent Agency in $7 Billion Deal

Luxury tycoon is in advanced discussions to buy a majority stake in Creative Artists Agency, according to people familiar with the matter, potentially adding another international trophy asset to the portfolio of a French billionaire.

The result confirms sector-wide fears that luxury demand would continue to slow.

IWC’s chief executive says it will keep leaning into its environmental message. But the watchmaker has scrapped a flagship sustainability report, and sustainability was less of a focus overall at this year’s Watches and Wonders Geneva.

The larger-than-life Italian designer, who built a fashion empire based on his own image, died in Florence last Friday.

This week, designers, collectors and major fashion brands will flock to Milan’s design fair. Also, LVMH reports first-quarter sales.