The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

SHANGHAI, China — Even as America appears more politically divided than it has been in recent history, the anti-China drum beat emanating from the White House, Senate and House of Representatives sees politicians of all stripes marching in unison.

In recent weeks, the US Senate has passed a bill that would require the delisting of any company on a US stock exchange that goes three consecutive years without being inspected by the Public Company Accounting Oversight Board (PCAOB). The bill has bipartisan support in the US House of Representatives and is likely to be made law in record time.

Chinese companies listed in the US have until now resisted these inspections because the Chinese Government believes PCAOB inspection of Chinese audit records would violate state secrecy laws. In short, the US-government is about to pass a law asking Chinese companies to comply with inspections their own government won’t allow.

This leaves US-listed Chinese firms — disproportionately tech-related companies and major e-commerce players like Alibaba, JD.com and Secoo, alongside social media darlings, like Bilibili — stuck between a rock and a hard place.

ADVERTISEMENT

The fact that the delisting threat comes at a time when US fashion and beauty companies are more intertwined than ever with Chinese tech giants — reliant on the likes of Alibaba and JD.com to sell to Chinese consumers, who are spending an increasing percentage of their yuan online in the wake of the coronavirus outbreak — may be cause for concern.

How Worried Should Brands Be?

One potential next step in the current stand-off is a wave of Chinese firms delisting from US exchanges, with approximately 150 companies set to reassess their positions. BoF reached out to Alibaba, JD.com and Secoo for comment, but they all declined, with a spokesperson for JD.com responding: “We don’t comment on market rumours.”

If... in Chinese media they're telling people 'do not buy iPhones,' you know this has taken on some serious implications.

According to Peter Boockvar, chief investment strategist at Bleakley Advisory Group, the core issue is about the potential for a delisting to aggravate US-China relations which are at the lowest point in recent history — and for strained relations to foment anti-American sentiment among Chinese consumers faced with buying American brands.

“If all of a sudden in Chinese media, they’re telling people ‘do not buy iPhones,’ you know this has taken on some serious implications,” he said.

The deepening animosity between China and the US exemplified by the delisting threat encompasses several years of a trade war and tit-for-tat tariffs. Yet so far it has not dented demand among Chinese consumers for American products, and according to Humphrey Ho, managing director of Hylink Digital, an agency that helps US brands market to customers in China, it is unlikely to any time soon.

"We can be patriotic, so long as the iPhones keep coming, and I can access the best vaccines for my child, and I can get that wine from Napa Valley," he said of the Chinese consumer attitude to US products.

In the fashion sector, US companies lead the way in terms of sportswear and streetwear, with both categories seeing impressive growth in the China market. According to Ho, there is no reason US companies in these or other fashion and beauty sectors are likely to suffer as a result of geopolitical tensions or economic decoupling between China and the US.

ADVERTISEMENT

“Consumers are very universal; they want to buy the best products for their families, for themselves, for their babies, and they will gravitate to the best product they can afford in that category,” he said.

Even in categories in which US companies have seen increased competition from domestic players, including sportswear and cosmetics, the rise of Chinese companies has been more about local companies improving their performance and catering better to their home market, rather than consumers moving away from US or international brands.

“I think US companies, like Nike, are doing really well in China. They have localised their management, staff, product offering and marketing very well,” explains Walter Woo, vice president of research at CMB International Capital Corporation.

“[But generally] the domestic players are doing better in knowing what consumers really want and they’re more aggressive on e-commerce, working better with Alibaba, JD and Pinduoduo. So, they are [doing] better with the product portfolio, as well as the channel management,” he added.

There should always be a sceptical eye in terms of the source, integrity, cleanliness of the data.

Luckin Coffee, a self-styled Chinese “Starbucks killer” — which saw dramatic growth in recent years, precipitating an even more dramatic fall as news of inflated sales figures wiped out 80 percent of the company’s share value overnight —has become an unfortunate poster child for the fast and loose accounting practices of some Chinese companies. This incident was nominally the reason for the US Senate to introduce its new legislation in the first place.

Questions raised about the veracity of the data emanating from Chinese companies were addressed by Alibaba’s Chief Financial Officer, Maggie Wu, on a recent earnings call. She sought to reassure Alibaba investors by pointing to Alibaba’s auditing by PwC Hong Kong which follows “auditing standards [that] are overseen by the PwC national office in the United States.”

“The integrity of Alibaba's financial statements speaks for itself. We have been an SEC [US Securities and Exchange Commission] filer since 2014 and hold ourselves to the high standards of transparency,” Wu added.

In addition to investors' concerns, brands partnering with Chinese technology firms also have legitimate questions about the veracity of their data. With international brands now largely dependent on firms such as Alibaba, Tencent, JD.com and Baidu for information about Chinese consumers, the famed big data operations of Chinese tech giants are naturally attractive, but how much should these numbers be relied upon?

ADVERTISEMENT

“There should always be a sceptical eye in terms of the source, integrity, cleanliness of the data,” Ho warns, though he adds that that same lens should be applied to data from any source, not just those coming from China.

“There should be [the same lens applied] in the West with Google or Facebook,” he says.

International firms, including L'Oréal and P&G, which currently work closely with Alibaba on big data for innovation, marketing and retail strategies gain a competitive advantage in the China market because of what they can do with that data. In other words, from a data perspective, there is far more to be gained than lost from working with Chinese tech giants.

Who Might Benefit from a Delisting?

According to Harvard Law Professor, Jesse Fried, writing in a The Financial Times op-ed, the move plays directly into the hands of China's Central Government.

At present, the threat of the US to delist Chinese tech giants remains just that, a threat.

“Beijing is unhappy that its biggest and most famous tech giants — such as Alibaba and Baidu — trade in the US and not at home. It wants its crown jewels back,” he wrote. “[B]y not allowing inspections, China can then trigger a ban and force its companies to leave the US. Some may then return home… [and] exits would be arranged by Chinese controllers to enrich themselves at public investors’ expense.”

As much as delisting from US exchanges might, on the surface, seem like a punishment for companies, or at least a move that might have a destabilising effect on these firms, Fried points to the case of Qihoo 360, an internet securities firm, as a model for the way in which delisting from US markets can actually improve the financial strength of Chinese companies.

In 2016, Qihoo’s founders squeezed out US shareholders at a valuation of $9.3 billion. In February 2018, Qihoo relisted on the Shanghai Stock Exchange at a valuation of more than $60 billion. Qihoo’s chairman made $12 billion — more than the whole company claimed to be worth 18 months before.

If US investors become wary and back away from Chinese companies ahead of potential delistings, it will make such manoeuvres a more attractive option for the controllers of those businesses.

Even more so than mainland Chinese exchanges or controllers, however, the major beneficiary of secondary or other listings looks to be Hong Kong. The Hong Kong Stock Exchange is already home to Alibaba’s secondary listing, which raised over $13 billion last November in one of 2019’s biggest offerings.

JD.com confirmed rumours of its secondary listing in Hong Kong just last week. If all goes to plan, it hopes to raise as much as $4.1 billion when it starts trading on June 18th, which is both the anniversary of the company’s founding and also a major e-commerce shopping festival in China.

These secondary listings — as well as the imminent Hong Kong listing of gaming company NetEase, which also initially listed on the Nasdaq, and potentially Pinduoduo, in an unconfirmed rumour — would be a major boost for Hong Kong’s reputation as a financial hub at a time when it faces multiple political and economic crises of its own.

“I’m not surprised to see companies looking for secondary or other listings in other places, especially in Hong Kong,” says Woo of CMB International Capital Corporation.

According to Brendan Ahern, chief investment officer at KraneShares, however, these relistings have little to do with the recent passage of legislation in the US Senate, or the broader deepening of competition and animosity among the world’s two largest economies. Rather, it’s about companies appeasing their most important master — the bottom line.

“Asian investors give their Hong Kong-listed peers a higher valuation than US investors. They also don’t trade them based on trade tweets or political rhetoric… capital flows to where it is treated best,” he wrote in a note.

It is this principle — companies being more sensitive to monetary value than geopolitics — that is likely to hinder London as a serious competitor to Hong Kong for more listings of China-based companies. Although Chinese authorities have reportedly encouraged listings in London, due to the London-Shanghai Stock Connect, the fact that it remains one of the most undersubscribed stock exchange connections utilised on a daily basis casts doubt on its value.

At present, the threat of the US to delist Chinese tech giants remains just that, a threat. As much as the ostensive aim of this new legislation is to protect US-based investors from investing in companies with dodgy accounting practices — a la Luckin Coffee — it is more likely to impact existing investment trends by accelerating them, including secondary listings in Hong Kong.

As much as the broader tensions between the US and China present a real threat to both countries and their respective economies, the threat to delist Chinese companies from US exchanges is unlikely to impact the day-to-day running of these companies and — thankfully for the international brands who have become increasingly reliant on Chinese consumers for sales in a post-pandemic world — little impact on their appetite for American brands.

时尚与美容 FASHION & BEAUTY

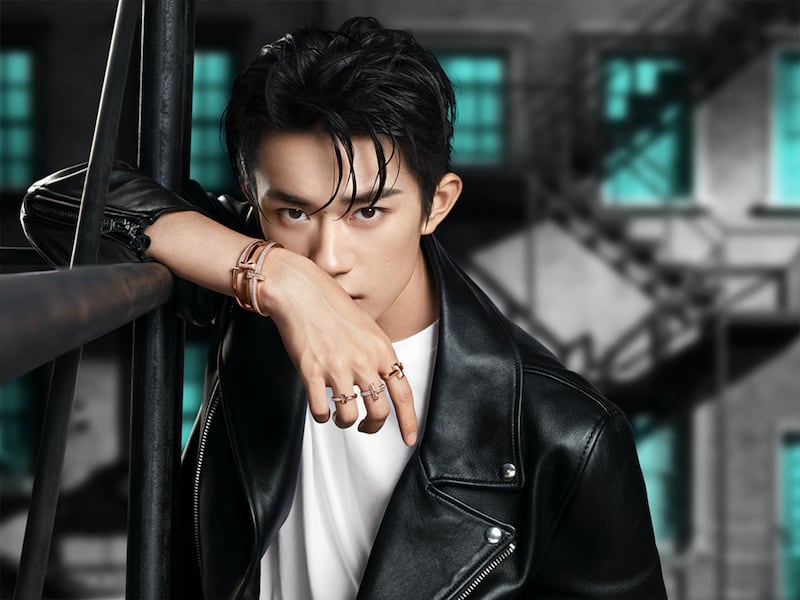

Jackson Yee for Tiffany T | Source: Courtesy

Tiffany Hopes New Face Will Boost China Sales Amidst Global Downturn

Tiffany & Co. has become the latest international luxury brand to anoint a xiao xian rou ("little fresh meat") idol in an attempt to increase market share in China, bringing Jackson Yee (Yi Yangqianxi from the TFBoys band) on board as brand ambassador for its Tiffany T collection. The world's second-largest economy proved a bright spot in its recent earnings announcement which saw a sales slump of 44 percent globally, but a 90 percent rise in sales in China since that market's re-opening. Yee follows other male celebs, including Kris Wu and Lu Han, fronting international luxury jewellery players in China and the news of his affiliation with the Tiffany T collection reliably created plenty of buzz on Chinese social media. (Jing Daily)

Chinese Cosmetics Brands See Market Rally

Low-cost, online-savvy local beauty brands in China have seen their shares rally as investors spy an opportunity for home-grown outfits to take market share amid the coronavirus crisis. Hangzhou-based Proya Cosmetics Co. has soared 88 percent this year, reaching a record high in May and is now trading at 68 times forward earnings, the highest among listed beauty companies worldwide and surpassing giants like Shiseido and Estée Lauder. Another local make-up brand, Guangdong Marubi Biotechnology Co. has surged 42 percent this year against a 3.9 percent decline in the Shanghai Composite Index and is now trading at 58.7 times forward earnings. (Bloomberg)

科技与创新 TECH & INNOVATION

A screenshot advertising the luxury livestream on Kuaishou

Kuaishou Tries to Move Upmarket with Luxury Livestream

While short video player Kuaishou is emerging as a major player on both the content and commerce fronts, the presence of luxury brands on the platform has been fairly limited to date. But on June 7, Kuaishou partnered with the high-end e-commerce platform Secoo to host its first large-scale luxury goods promotion with a five-hour broadcast featuring products from Hermès, Rolex, Gucci and dozens of other brands, selling a total of 105 million yuan ($14.85 million) worth of items. In a move that luxury brands may not endorse, Kuaishou relied heavily on subsidising significant discounts to move goods. For example, a Birkin bag that retails for 380,000 yuan ($53,740) was reportedly offered for just 99,999 yuan ($14,141). (Content Commerce Insider)

Tencent Launches Sesame Credit Competitor

Chinese tech giant Tencent has launched a credit scoring system based on what users buy over its ubiquitous WeChat app, allowing it to offer consumer credit services on its platform. The scores are based on users' WeChat payment history, credit records and verified personal information. Those with solid credit records can enjoy "use first, pay later" privileges, deposit-free rentals of shared bikes and power banks. The scoring system is very similar to Zhima Credit, also known as Sesame Credit, launched in 2015 by competitor Ant Financial Services Group, an affiliate of Alibaba Group. (Caixin)

消费与零售 CONSUMER & RETAIL

Korean Brand Innisfree is one of the first to be made available in major Chinese cities through Eleme | Source: Courtesy

Beauty and Fashion Find a Place on Food Delivery Apps in China

The retail environment in post-pandemic China has necessitated the acceleration of digital retail models, so perhaps it shouldn't be a surprise that beauty brands, like Korea's Innisfree, are making themselves available on food delivery app Eleme, in cities such as Beijing, Shanghai, Guangzhou and Shenzhen. Eleme was acquired by Alibaba in 2018 and is reportedly looking to expand its purview beyond delivering lunch to hungry office workers, to other categories, including fashion. (Irina Li for BoF China)

Mainland China Retailers Expect Business as Usual Within 12 Months

More than 80 percent of mainland China retailers expect business to return to pre-Covid-19 levels within 12 months, according to CBRE's latest Asia Pacific Retail Flash Survey. While retailers intend to consolidate brick-and-mortar store networks and increase their focus on online sales capacity, 13 percent of mainland China respondents plan to open new stores — the second highest in percentage among all markets surveyed. (Yicai)

政治,经济与社会 POLITICS, ECONOMY, SOCIETY

An outdoor night market in the city of Xian | Source: Wikimedia Commons

China Looks to Street Vendors for Economic Boost

Chinese cities have spent years eradicating street vendors and markets in an effort to "beautify" and modernise, but a single comment from Li Keqiang last week may have changed that course. The Premier complimented the efforts of a city in Shandong Province, which has recently allowed 36,000 mobile stalls to be set up along its roadside, creating 100,000 jobs in a post-pandemic environment in which addressing joblessness is the Chinese government's number one concern. The idea has enormous appeal among a populous nostalgic for the country's street market culture but has met resistance from city officials who will be charged with managing street stalls and enforcing health standards. (South China Morning Post)

Chinese Social Media Shows a Mix of Reactions to #BLM Protests

Official Chinese media reports of widespread protests across the US sparked by the death of George Floyd at the hands of police have been almost gleeful in their documentation of chaotic scenes and a populous divided. Voices from ordinary people on social media, however, have been far more nuanced, and in many cases, supportive of the #blacklivesmatter movement. Comparisons to Hong Kong are never far from the surface, nor are comparisons to China's own issues with racism, just last month tensions flared over the treatment of African residents of Guangzhou, prompting condemnation from African governments. (Radii China)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.