The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

As soon as pandemic travel restrictions were lifted, top luxury executives including Bernard Arnault, François-Henri Pinault and John Idol flocked to China on whistlestop tours combining store visits with high-level meetings with politicians and business owners, underscoring the strategic significance of the market.

After a disastrous 2022, during which lockdowns contributed to a 10 to 15 percent decrease in luxury spending, Chinese consumers flocked back to the shops. The results were double-digit sales growth in the region for most luxury brands, offsetting sluggish to declining performance in North America.

But much of the initial growth this year has been attributed to “revenge shopping” as luxury consumers, frustrated by last year’s lockdowns, splurged with abandon. Now that the thrill of re-opening has subsided and the country’s economy is faltering, falling into deflation, where should luxury brands place their bets?

Targeting the Chinese consumer at home has become increasingly important. Since 2020, domestic luxury consumption has significantly outstripped luxury spending by Chinese tourists, mainly as a result of the pandemic but also because of a number of measures introduced by the government to increase spending at home, such as tax cuts and increased duty free allowances on e-commerce purchases, cracking down on “Daigou” grey market sales and diverting their business to cross-border e-commerce sites operating under Chinese law, and providing financial incentives to foreign brands for opening their first stores in Mainland China.

ADVERTISEMENT

BoF Insights estimates that the repatriation of Chinese luxury spending will persist in the medium-term, with two-thirds of the $131 billion in Chinese luxury purchases made each year to occur in mainland China, a reversal from pre-pandemic times.

As a result, brands have moved to upgrade their Chinese retail presence. Hermès is renovating and expanding its stores at the Peninsula Hotel in Beijing (the birthplace of luxury retail in China) and Nanjing’s Deji Plaza as well as opening a new store in the northern coastal city of Tianjin, whilst Chanel and Dior have expanded existing stores and targeted Central China (Zhengzhou) for further retail development.

Hainan, the tropical tax-free shopping haven in the South China Sea, has also exploded in importance for luxury brands since the introduction in 2020 of a range of tax-free incentives aimed at the 75 million or so annual, mostly Chinese, visitors to the island. In 2019 duty free sales revenue in Hainan totalled €1.7 billion; the target for this year is reported to be around €11 billion. In October 2022, China Duty Free Group opened the world’s biggest duty-free mall in Hainan’s capital Haikou, generating over €8 million in sales on its first day..

This stellar growth is likely to continue as the Chinese government has recently further relaxed tax-free shopping restrictions — notably by allowing certain products to be picked up whilst still on the island as opposed to at the exit port — and plans not only to increase the number of product categories eligible for duty-free status but also will designate the whole 35,000 square kilometre island duty-free in 2025.

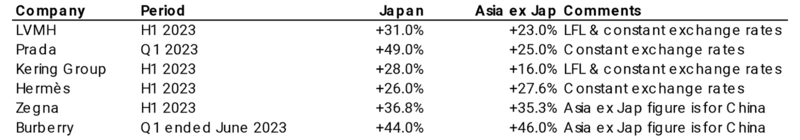

The ongoing difficulty in obtaining visas for many overseas trips, lower availability of international flights (and thus higher air fares) as well as the Ukraine War’s dampening impact on European tourism mean that outbound travel to key luxury destinations in the West is far from where it was pre-pandemic and where luxury brands would like it to be. Regional travel is nevertheless picking up, with destinations in Japan, Thailand and Singapore topping the most-visited list. This has translated into bumper double-digit sales growth in Japan for many players.

But as brands increasingly move towards global pricing strategies and the product selection and experience at their Mainland China stores matches if not exceeds what they offer elsewhere in the West, the incentive for Chinese tourists to spend abroad is diminishing. Whilst there is clearly a feel-good factor from shopping at Dior’s flagship store on Avenue Montaigne which cannot be replicated at home, brands will have to up their game to convert regional tourists into customers.

Perhaps one way to do this is to take a more holistic approach to Chinese customers and not segment them into domestic consumers and tourists. CRM tools can be used to track Chinese customers at home or abroad and can be used to offer a seamless service by, for example, allowing customers to view products or book appointments before travelling. Unique in-store experiences and Instagrammable window displays are other ways brands can attract Chinese tourists.

With youth unemployment at historical highs and property prices down, the middle-class consumer which has driven much of the recent growth in Chinese luxury sales is taking a break from spending. The higher end of the market, however, shows few signs of slowing down and, according to a recent survey by BoF Insights, high net worth luxury consumers are feeling optimistic about the future which enhances their propensity to spend. According to Morgan Stanley, less than 1 percent of customers could account for as much as 40 percent of sales in some key luxury malls in China.

ADVERTISEMENT

Brands positioned at the higher end of the market and which have been nurturing their relationships with their Very Important Clients (“VICs”) stand to benefit the most from this trend. And we can see some of the bigger brands taking note of this: Chanel is reportedly opening VIC salons in Guangzhou and Shenzhen, having opened a similar salon at SKP Beijing last year alongside Dior and Louis Vuitton.

The “velvet rope” impact of these VIC offerings cannot be underestimated. James Hebbert from Hylink, a Beijing-based advertising and communications agency with clients in luxury goods, maintains that “once you’ve experienced the VIP service, no one likes to accept a consumption ‘downgrade’ to the regular boutique.” Reportedly, VIC or VVIC status is not lifelong: clients need to keep up their high purchase volume to retain membership and the better and the more exclusive the experience, the less high net worth individuals want to miss out.

This approach very much favours the larger more established brands given the substantial financial resources required to build VIP salons, staff them and stock them with high-priced items. However, smaller niche brands can jump on this opportunity by investing in CRM tools not only to track their online customers but also capture physical retail customers and, crucially, provide a seamless omnichannel service/experience to their high-spending customers.

But despite the current headwinds facing the middle classes, the long-term growth prospects of the middle-to-high income population in China bodes well for luxury. Bain forecasts that this lucrative population segment will grow to 250 million people by 2030 whilst Morgan Stanley expects Chinese consumers to increase luxury goods purchases this year, accounting for 60 percent of spending growth by 2030.

The bottom line is the sheer size of China and its importance in luxury consumption means that there is no viable candidate around to replace it as the next big opportunity. The short-term opportunities favour higher-end, more established brands with stronger customer relationships but there is also scope for future growth in the affordable segment and niche brands as the market matures.

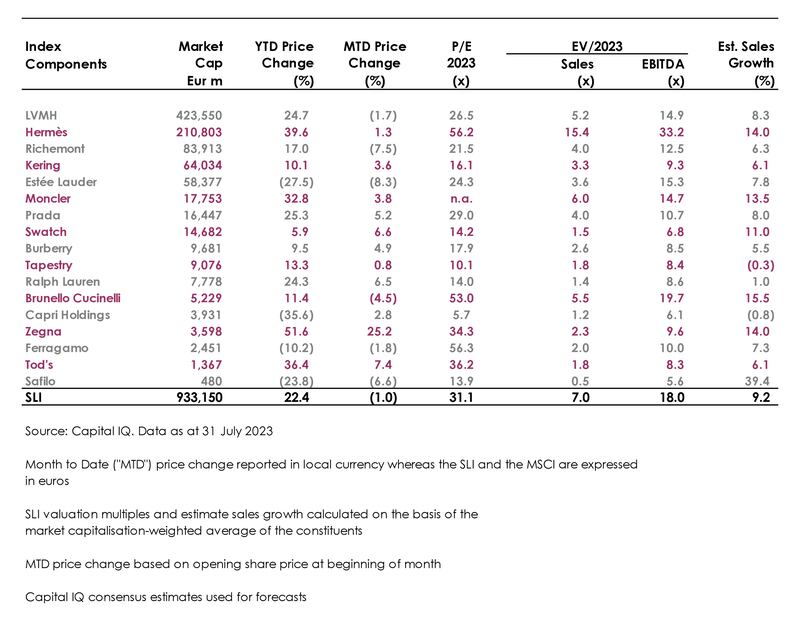

The Savigny Luxury Index (“SLI”) lost 1 percent in July in a rollercoaster month during which positive results conflicted with worries over the wider economic outlook, notably the prospect of further interest rate rises. Conversely the MSCI gained 2.5 percent during the month. Both indices are neck to neck with year to date performance of the SLI at +17 percent vs the MSCI at +15 percent.

Going up

Going down

ADVERTISEMENT

What to watch

The slowdown in luxury spending in the US has been gathering pace in the second quarter as successive interest rate hikes started hitting the affordable luxury segment hard. Whilst interest rates were held in June, they have subsequently been raised again in July with the Fed leaving the door open to further hikes before year end. So far, growth in China has masked the decline in the US. Will this persist?

Opens in new window

Opens in new windowChinese fashion and beauty customers — long pivotal for the global luxury market — are reshaping how and where they shop, according to BoF Insights’ new report.

The Hood By Air co-founder’s ready-to-wear capsule for the Paris-based perfume and fashion house will be timed to coincide with the Met Gala in New York.

Revenues fell on a reported basis, confirming sector-wide fears that luxury demand would continue to slow.

IWC’s chief executive says it will keep leaning into its environmental message. But the watchmaker has scrapped a flagship sustainability report, and sustainability was less of a focus overall at this year’s Watches and Wonders Geneva.

The larger-than-life Italian designer, who built a fashion empire based on his own image, died in Florence last Friday.