The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

The Covid-19 pandemic precipitated an enormous human and economic catastrophe, ushering in a period of disruption and volatility that shows no signs of abating. In just the last week, Russia’s invasion of Ukraine stunned and outraged the world. The pandemic and the recent conflict in Europe are the latest indications that an era of relative stability in the world order — and supply chains — is coming to an end.

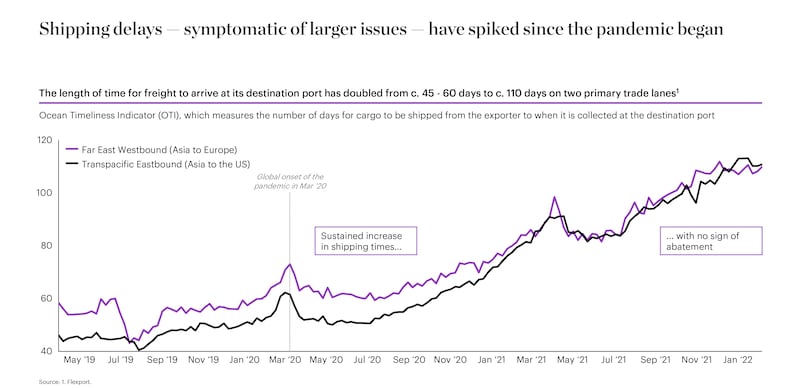

For the fashion industry, the pandemic magnified fragilities and vulnerabilities in its supply chain given the industry’s labour intensity and the sprawl of its global operations. It exposed existing issues, including difficulties in safeguarding human rights, navigating geopolitical tensions and improving environmental standards. It also created new challenges, such as an unforeseen surge in consumer demand coupled with operational bottlenecks in key hubs and transit points.

Indeed, even before Russia’s invasion of Ukraine, senior fashion executives ranked supply and value chain pressures as the top theme that will shape the fashion industry in 2022.

Building Resiliency and Value in Fashion’s Supply Chain is the third in-depth report to be published by BoF Insights, a new data and analysis think tank from The Business of Fashion that arms business leaders with proprietary and data-driven research to navigate the fast-changing fashion industry.

ADVERTISEMENT

In this report, BoF Insights identifies five secular shifts that have been affecting fashion’s supply chains:

The report also surveys senior fashion executives to understand their leading concerns and priorities, revealing that:

The report concludes with a brand and retailer playbook that is designed to help companies move away from attempting to solve the supply chain “trilemma” — balancing speed, reliability and cost when only two factors can be achieved at any one time. Instead, BoF Insights outlines a discrete set of value-creating initiatives that focus on improving visibility across, velocity in and the ultimate viability of fashion’s supply chains.

30 interviews with founders, senior executives and academicians drawn from:

An exclusive BoF Decision-Maker Survey fielded by BoF across its global community of fashion professionals, representing a cross-section of senior decision-makers across a leading set of fashion brands and retailers.

Companies covered and/or interviewed in the report include American Eagle Outfitters, ASKET, ASOS, DXM Inc., Flexport, Katla, Kavida.ai, Li & Fung, Linc, MANGO, Neiman Marcus, Nordstrom, Ohi, On, PANGAIA, Panjiva, Quiet Logistics, Reformation, Saint Art, Shahi Exports, SHEIN, SILQ, SXD, Syrup Tech, TextileGenesis, TrusTrace and Zalando.

BoF Insights is The Business of Fashion’s data and advisory team, partnering with leading fashion and beauty clients to help them grow their brands and businesses. Get in touch at insights@businessoffashion.com to understand how BoF Insights support your company’s growth for the long term.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.

Manhattanites had little love for the $25 billion megaproject when it opened five years ago (the pandemic lockdowns didn't help, either). But a constantly shifting mix of stores, restaurants and experiences is now drawing large numbers of both locals and tourists.