The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

What is beauty? It’s a question philosophers have pondered for centuries. And now it’s increasingly one being asked across the beauty industry. A convergence of factors means brands and retailers are confronting deep shifts in what once was a relatively straightforward business of helping people look good.

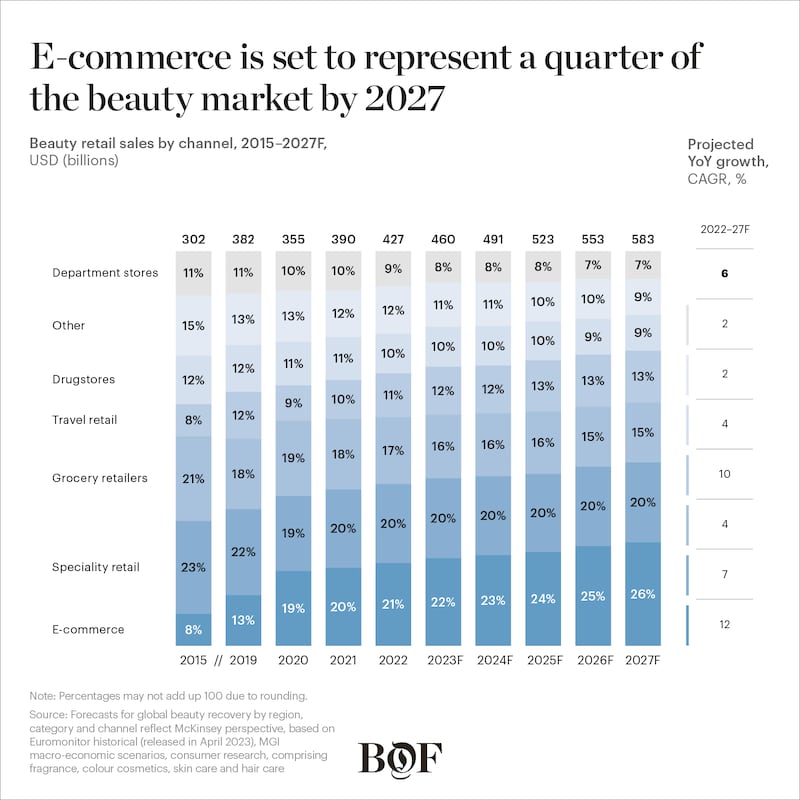

Before this decade is over, today’s $427 billion beauty industry will have reshaped itself around an expanding array of products and markets. Consumers, particularly younger generations, will be spurring this reshaping, as their own definitions of beauty morph while their perceptions of everything from their role in sustainability to the importance of self-care evolve. Brands and retailers will also change, seeking greater agility and adopting multichannel operating models. They will be doing this as competition in an already crowded market continues to intensify across all categories — skin care, makeup, fragrance and hair care.

This special edition of The State of Fashion by The Business of Fashion and McKinsey & Company explores the global beauty industry through a set of key dynamics impacting brands and retailers in 2023 and beyond. The report uses market intelligence, insights from industry executives and other experts, and proprietary analysis to identify top business opportunities, while also providing both price segment- and category-wide retail sales forecasts over a five-year period to 2027. To enrich this report, McKinsey also conducted a global survey capturing the shopping behaviours and preferences of consumers in six core beauty markets.

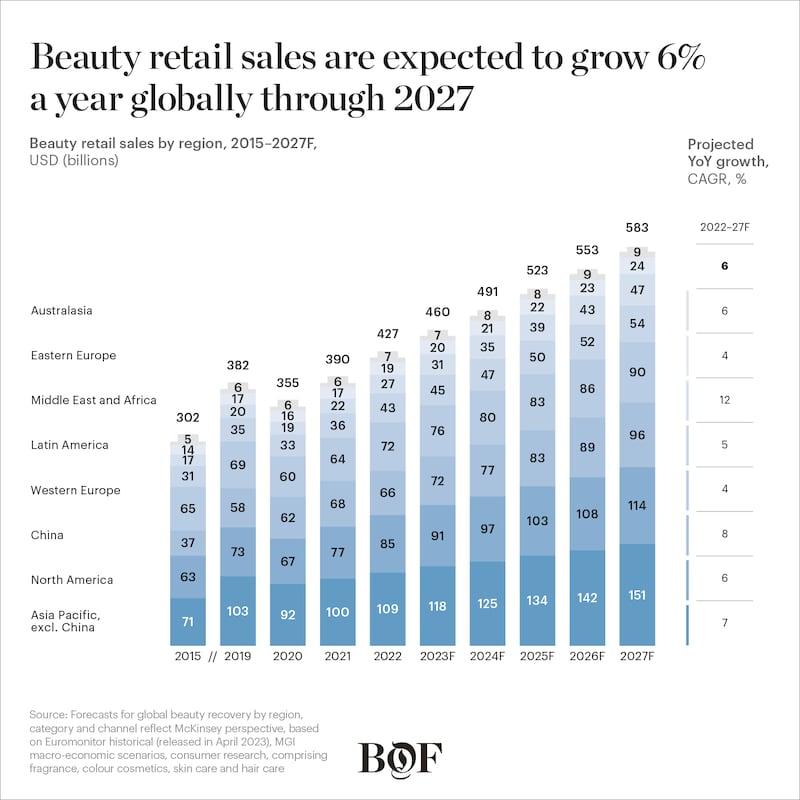

The big takeaway is that the beauty market is expected to continue demonstrating the resiliency it has cemented in recent years, showing that time and time again it can withstand — and even thrive profitably and grow — amid economic turbulence, while other consumer sectors struggle. It’s now an industry that everyone from top-tier financiers to A-list celebrities wants to be a part of, with good reason. McKinsey estimates that by 2027, the global beauty industry will record over $580 billion of retail sales, growing at 6 percent per year.

ADVERTISEMENT

How the industry reaches that figure depends on brands’ and retailers’ ability to navigate the dynamics that this edition of The State of Fashion explores: new geographic hotspots; the burgeoning luxury opportunity; the route for emerging brands to scale; the evolving landscape for mergers and acquisitions; the steady rise of wellness-related beauty; and the complexities of the Gen-Z beauty consumer.

First and foremost, geographic diversification is more essential than ever. It was only recently, for example, that brands could focus their footprints on the industry’s two top countries — China and the US. Both markets will remain mighty forces for the industry — with China estimated to reach approximately $96 billion by 2027 and North America approximately $115 billion. But in both markets, various factors mean growth will be harder to come by for individual brands. However, there is a silver lining: other countries and regions are ready to step into the limelight, including the Middle East and India. Brands can also find opportunities by targeting consumers with products and services in the top tier of the pricing pyramid: luxury beauty has the potential to grow from around $20 billion today to around $40 billion by 2027.

The next few years will also be a period of reckoning for some brands that until recently had carved out niches for themselves and whose reputations were built on disruption. These challenger brands have begun treading the same bumpy path as other small and medium-sized brands in their quest for scale. For sure, a beauty brand’s trajectory to $20 million in annual sales will continue to be quite different from the one to $250 million or $800 million, especially with the vast number of brands entering the industry.

However, brands highlighted in this special edition that have successfully broken through barriers to growth show how the rulebook for scaling can be rewritten, with a laser-sharp focus on building out international footprints and channels and smart funding considerations. Mergers and acquisitions might have a role to play here. As in recent times, conglomerates and financial investors alike will pursue deals to invest in promising brands. But deal-making will be different in the near term. Megadeals will likely be few and far between in response to both market turbulence as well as the need for brands to demonstrate an ability to grow profitability with innovative product pipelines.

Another dynamic driving beauty’s future circles back to the question of what beauty is. It’s front of mind for many beauty consumers, and for that we can thank Gen-Z. This generation, today’s teens and twentysomethings who will represent a quarter of the world’s population by 2030, has outsize influence over the industry given, for example, their command of social media channels to voice likes and dislikes, influence older generations of consumers, and challenge mainstream views of what constitutes a beautiful person.

Beauty’s definition will continue to broaden to encompass much more than the lipsticks, face masks and perfumes associated with the sector as consumers seek to look and feel good. Nowhere will this be more evident than in beauty’s steady march into wellness. As part of today’s $1.5 trillion global wellness industry, wellness-inspired products — from ingestible supplements to sleep aids to lotions made using ancient medicinal traditions — have already captured the attention of consumers as well as retailers embracing greater self-care and mindfulness in our post-pandemic daily routines. The melding of wellness and beauty is only expected to become more pronounced, with McKinsey expecting compound annual growth of 10 percent to 2027 for the wellness industry.

Ultimately, the years ahead will offer all the right ingredients — from agile channel mixes to consumers eager to explore new products — to propel the industry. For beauty leaders, it will be a unique time to flourish, with strategies that reflect a new face for beauty.

The report identifies five critical dynamics for the industry over a five-year period to 2027:

ADVERTISEMENT

1. The New Growth Map

Beauty’s international growth blueprint of the past decade needs a refresh. China, though still a powerhouse, can no longer be the sole growth engine for brands. The US, which will continue to be the biggest market in the world, will increase in importance for the industry even as competition for market share intensifies. Other markets, notably the Middle East and India, may offer a range of ways to offset those challenges.

2. Wellness Awakens

A new definition of beauty is reshaping the market as consumers shift their objectives from aesthetic perfection to holistic wellbeing. Brands can tap into emerging wellness sub-categories — from sleep to sexual intimacy to ingestible beauty — to upgrade their existing products and expand their portfolios, provided they do so with credibility and authenticity.

3. Decoding Gen-Z

As Gen-Z grows up, brands must adapt, finding new ways to speak their language. This may require retiring traditional ways of doing business — from marketing to product development — and rethinking assumptions about this diverse, digitally savvy and demanding generation that prioritises value and efficacy when choosing their beauty brands and products.

4. The Scale Imperative

For many emerging beauty brands, the early days of getting up and running has been the relatively easy part. Now, they need to confront the greater challenges that continuing their growth trajectories entail. In an industry that has become overcrowded, geographic and channel expansion will likely be critical for gaining further market share.

ADVERTISEMENT

5. M&A Recalibrated

In the short term, beauty mergers-and-acquisitions activity may not deliver as many megadeals as seen across the industry in the past, but the deal-making will continue to be buoyant. The potential benefits for buyers and sellers remain as strong as ever, playing a pivotal role in strategies focused on international growth, innovation and competitive product portfolios.

For a deeper look into the report, join us for the global livestream of The Business of Beauty Global Forum on May 30 and 31, 2023. Click here for all the details on how to sign up.

Join the global livestream on May 30 and 31, 2023 to unlock essential learnings, challenge conventional thinking and inspire innovation in the global beauty and wellness industry.

Imran Amed is the Founder, CEO and Editor-in-Chief of The Business of Fashion. Based in London, he shapes BoF’s overall editorial strategy and is the host of The BoF Podcast.

The firm has been working on a listing since at least 2022, with previous attempts buffeted by volatile markets.

In a three-part series, The Business of Beauty explores how Black founders Monique Rodriguez, Danessa Myricks and more built, launched and scaled their multi-million-dollar businesses. In part one, a look at how these entrepreneurs found their niche and harnessed early lessons that were critical to their growth

There’s something both innocent and concerning about 13-year-olds’ obsession with skincare. Kids will always want to find new ways to express themselves, but the beauty industry has a responsibility to protect its youngest customers.

The family-owned Spanish conglomerate has confirmed it will pursue a public offering in the coming months. After a fairly fast transformation, the company now has a bold diversification strategy and a strong mix of brands in place, making it more ready than it has ever been for the European markets.