The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

When the Prada Caffè opened at Harrods in London earlier this month, a viral TikTok reel showcasing the cafe recorded 220,000 views within the first 24 hours of its posting. Viewers left comments swooning about the eye-catching details like Prada-branded cutlery and made comparisons to the recent hospitality ventures of other luxury fashion players, including the pop-up Dior cafe that also opened at Harrods the prior year.

Expanding into adjacent categories like design and hospitality is not new for many fashion and beauty brands. Ralph Lauren launched a home business in 1983; Fendi established its Fendi Casa joint venture in the same decade. What is new is the momentum such expansions are gaining, particularly since the Covid-19 pandemic has led to consumers placing greater importance on the spaces in which they live, work and socialise.

Since 2020, brands ranging from Aquazurra and Fendi to Sézane and Rhode have launched home collections. Meanwhile, mass fashion players such as Boohoo, Mango and Gap have seized the opportunity as customers show new openness to purchase their branded homeware at generally higher prices than their apparel.

Amid this change. BoF Insights’ latest report, The Lifestyle Era: Luxury’s Opportunity in Home and Hospitality, explores the dynamics behind the lifestyle boom and how brands can maximise the opportunity to extend their brand universe and unlock new avenues of growth.

ADVERTISEMENT

According to market research firm Euromonitor International, sales in home and hospitality categories will grow at a compound annual rate of approximately 7 percent through 2026, outpacing pre-pandemic growth of 4 percent. Fuelling this acceleration are key post-pandemic shifts such as hybrid work and growing consumer interest in “experiential goods,” like notable items to use and showcase while entertaining at home. Customers are also looking for more novel, immersive experiences, including at exclusive restaurants and hotels.

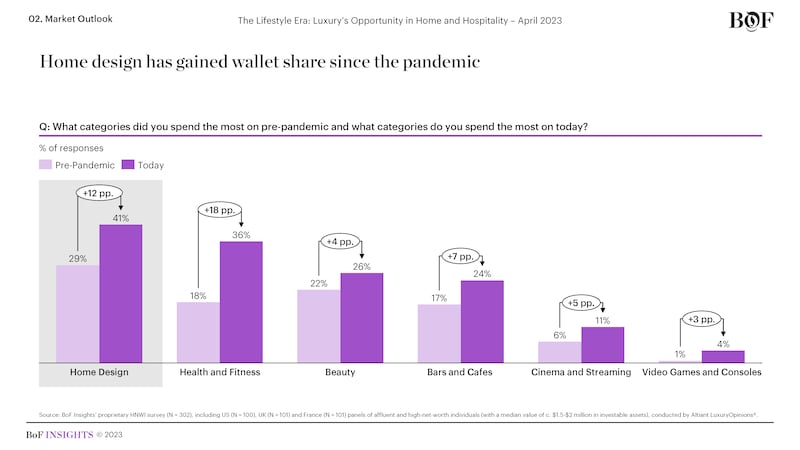

In a proprietary survey with luxury research provider Altiant, BoF Insights found that high-net-worth individuals are spending more on home design today than before the pandemic. Affluent shoppers in the US, UK and France say they are spending more on furniture, decor, textiles, fragrances and tableware now than before 2020, leading to a 12 percentage points post-pandemic increase.

Around half of those surveyed say they shop for home design products to refresh the style of their living spaces or to upgrade their surroundings for a more premium feel.

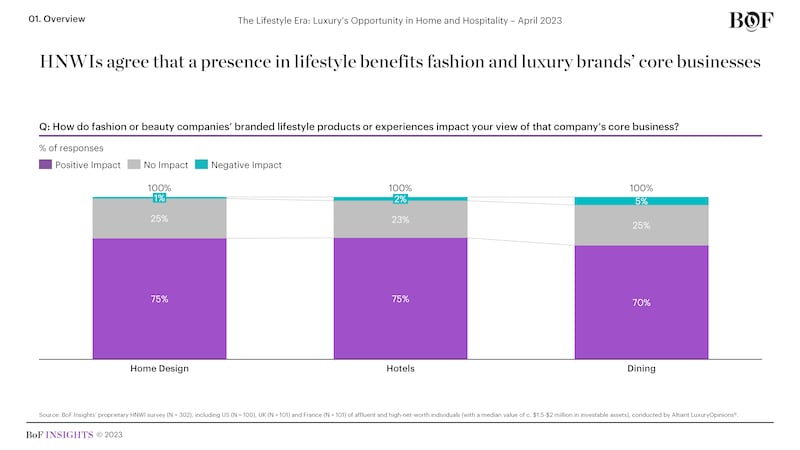

Fashion and beauty brands are betting on these categories to not only open new revenue streams but also extend customer touchpoints and build greater brand affinity. More than 70 percent of surveyed HNWIs say home design and hotel extensions have a positive impact on how they perceive fashion and beauty brands.

Hotel and dining extensions can provide especially strong affiliations between brand and customer by creating immersive, memorable experiences, ranging from personalised menus, such as Café Kitsuné's drinks and desserts customised by location, to VIP services like those available at Boucheron’s private apartment in Place Vendôme in Paris.

These ventures can also showcase a brand’s home offering. BoF Insights found that over 30 percent of surveyed HNWIs are more likely to purchase from a brand’s home collection after a branded hospitality experience.

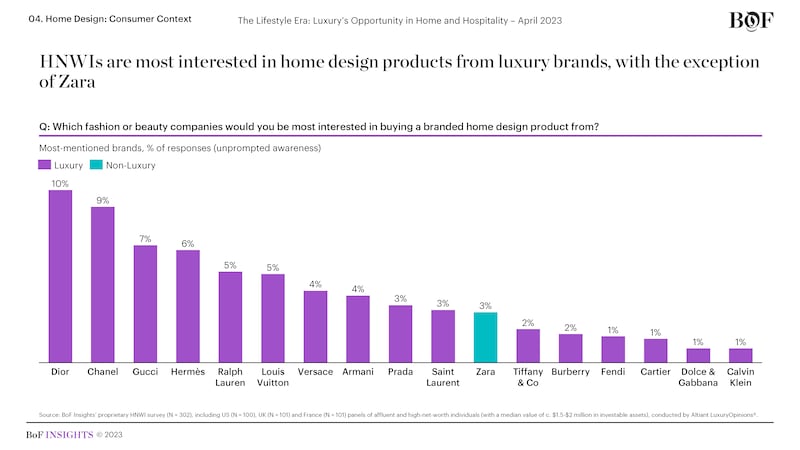

Affluent shoppers cite Dior, Chanel and Gucci as the brands they would be most interested in buying home design products from. Notably, however, Zara was the only non-luxury brand to appear in the top 20 most-mentioned brands in our survey, indicating how expansions into home can enable mass brands to achieve a more premium positioning in that category.

Brands expanding into lifestyle must have fresh narratives for these ventures, ensuring the tone isn’t gimmicky and resonates with customers’ desire for quality and tastefulness. Gone are the days when printing a luxury logo onto an everyday item would attract customers. Accordingly, BoF Insights explores a framework for fashion and beauty brands’ investment into lifestyle categories, and the respective tactics to deploy to reach their desired target audiences.

BoF Insights is The Business of Fashion’s data and advisory team, partnering with leading fashion and beauty clients to help them grow their brands and businesses. Get in touch at insights@businessoffashion.com to understand how BoF Insights support your company’s growth for the long term.

Rawan Maki is Associate Director of Research and Analysis at the Business of Fashion (BoF). She is based in London and is part of BoF’s Insights team, which arms fashion and luxury executives with proprietary business intelligence.

Benjamin Schneider is the Senior Research Lead at the Business of Fashion (BoF). He is based in New York City as part of BoF’s Insights team, which arms fashion and luxury executives with proprietary business intelligence.

The Hood By Air co-founder’s ready-to-wear capsule for the Paris-based perfume and fashion house will be timed to coincide with the Met Gala in New York.

Revenues fell on a reported basis, confirming sector-wide fears that luxury demand would continue to slow.

IWC’s chief executive says it will keep leaning into its environmental message. But the watchmaker has scrapped a flagship sustainability report, and sustainability was less of a focus overall at this year’s Watches and Wonders Geneva.

The larger-than-life Italian designer, who built a fashion empire based on his own image, died in Florence last Friday.