The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

As fashion players scan the globe for growth opportunities in early 2023, it’s with good reason that many are now pivoting their focus towards the Middle East. Riding on the back of strong growth in 2022, several markets in the region increasingly offer both the local and international fashion industries more avenues to expand their businesses. For brands and retailers that have the creative and financial bandwidth, this could translate into entirely new, or vastly expanded, customer bases.

Many of these customers have growing spending power, thanks in large part to the strength of their local economies. Notably, the GDP of the Gulf Cooperation Council (GCC) countries is forecast to grow 3.7 percent compared to 1.5 percent for the overall global economy, according to economists at Oxford Economics.

How this can translate into opportunities for both mass market and luxury players is the latest report from BoF Insights, Fashion in the Middle East: Optimism and Transformation. What’s clear from the report’s research is that the tastes and behaviours of fashion shoppers in the Middle East are evolving rapidly, spurred in part by shifting societal norms and large-scale investments in public spaces.

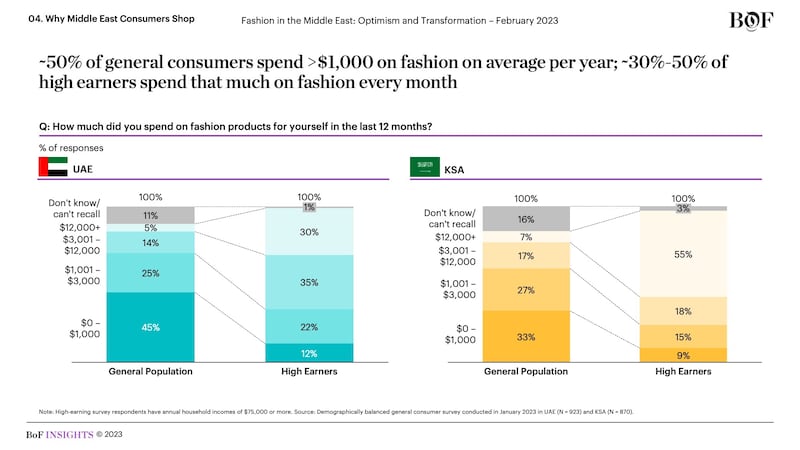

In a recent BoF Insights survey in two key GCC economies — the United Arab Emirates and the Kingdom of Saudi Arabia — approximately half of the respondents say they spend $1,000 on fashion on average a year. The amount shoots up significantly among surveyed high earners, with annual household incomes of $75,000 or more, with approximately 30 percent in the UAE and 50 percent in the KSA spending $1,000 on average a month.

ADVERTISEMENT

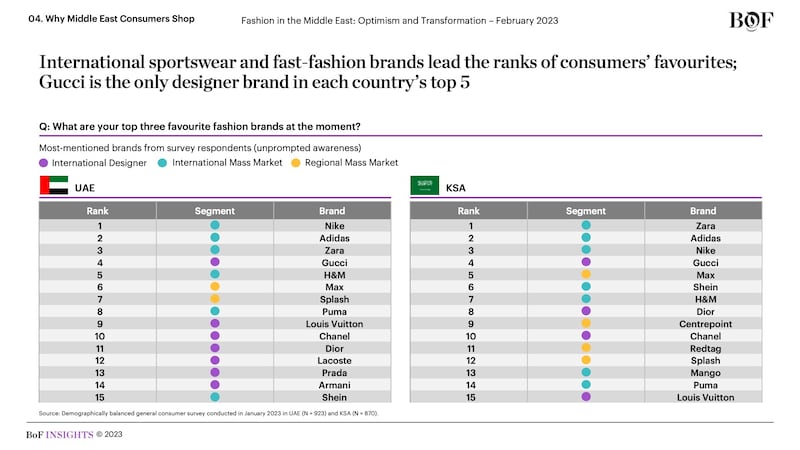

When asked about what they are looking for when making fashion purchases, these high earners in both countries say quality and elegance are among the most important characteristics. Modesty falls into the middle of these considerations, likely due to the ability of consumers to style clothing as needed to suit their preferences. In terms of brands, Nike, Adidas and Zara dominated consumers’ favourites, while Gucci was the only designer brand to make the top five for survey respondents. Other designer brands in the top 15 for both UAE and KSA surveyed consumers include Louis Vuitton, Chanel and Dior.

Digging a little further, BoF Insights also found that societal changes — such as more women entering the workforce — are impacting fashion choices. While accessories like handbags and jewellery were once the purchase priorities — partly due to norms around modesty and the ability of accessories to complement traditional outfits — consumer tastes are evolving as the variety of life experiences is increasing. Consumers in the nationally representative surveys were actually most interested in purchasing shoes, beauty and everyday apparel over the next 12 months.

Developing a richer, nuanced understanding of consumers will be key as international brands and retailers look to enter and grow in the Middle East, where fashion industry sales are expected to increase 11 percent year-over-year in 2023, according to data from market research provider Euromonitor International. The region has a predicted CAGR of approximately 7 percent between 2023 and 2027. The KSA and the UAE together account for about half of the $89 billion market value.

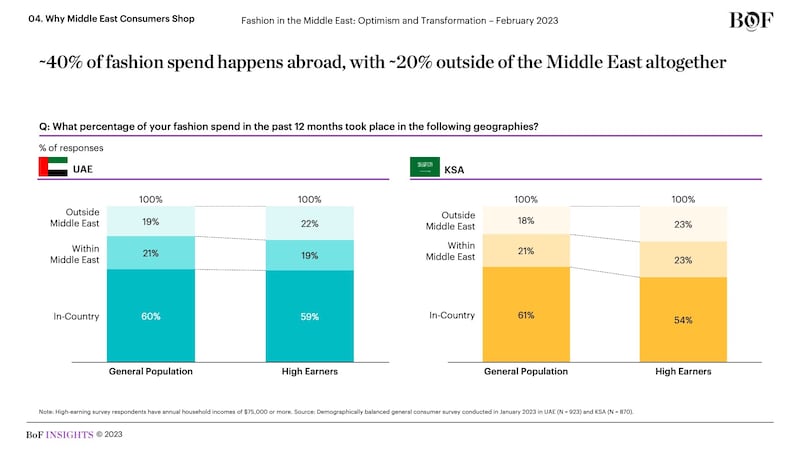

Meanwhile, BoF Insights’ survey finds that international brands and retailers can find ways to connect with shoppers both inside and outside of the Middle East. About 40 percent of total fashion spend takes place outside the region, though significant amounts of overseas spend were repatriated during the Covid-19 pandemic. As such, these consumers are increasingly demanding enhanced shopping experiences and a broader product assortment closer to home.

International brands and retailers have a significant opportunity to provide collections that resonate with the UAE and KSA’s well-travelled customer base by developing flagships in the region, in addition to hosting local brand activations and offering region-exclusive products.

But particularly at home, Middle East customers are raising the bar in terms of what they expect from their consumer journeys, whether online or in-store.

“The Middle East customer — especially Millennials and Gen-Zers — expect brands to take a hyper-local and personalised approach to every aspect of their offering,” said Felicity Fidler, head of international marketing at Harrods, adding that because its GCC clientele comprise more than 10 percent of the London department store’s sales, having an on-the-ground consumer insight is important for it.

As Fidler and other experts speaking to BoF Insights for the report explained, meeting customer expectations requires in many ways far more commitment to localisation than ever, with every customer interaction reflecting the region’s creative and cultural new dynamism.

ADVERTISEMENT

BoF Insights is The Business of Fashion’s data and advisory team, partnering with leading fashion and beauty clients to help them grow their brands and businesses. Get in touch at insights@businessoffashion.com to understand how BoF Insights support your company’s growth for the long term.

Rawan Maki is Associate Director of Research and Analysis at the Business of Fashion (BoF). She is based in London and is part of BoF’s Insights team, which arms fashion and luxury executives with proprietary business intelligence.

Benjamin Schneider is the Senior Research Lead at the Business of Fashion (BoF). He is based in New York City as part of BoF’s Insights team, which arms fashion and luxury executives with proprietary business intelligence.

This week’s round-up of global markets fashion business news also features the China Duty Free Group, Uniqlo’s Japanese owner and a pan-African e-commerce platform in Côte d’Ivoire.

Affluent members of the Indian diaspora are underserved by fashion retailers, but dedicated e-commerce sites are not a silver bullet for Indian designers aiming to reach them.

This week’s round-up of global markets fashion business news also features Brazil’s JHSF, the Abu Dhabi Investment Authority and the impact of Taiwan’s earthquake on textile supply chains.

This week’s round-up of global markets fashion business news also features Dubai’s Majid Al Futtaim, a Polish fashion giant‘s Russia controversy and the bombing of a Malaysian retailer over blasphemous socks.