The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

After avoiding lab-grown diamonds for years, luxury brands are finding they have their uses.

In recent months, Prada, watchmaker TAG Heuer and LVMH-owned jeweller Fred have all unveiled new products featuring lab-grown stones. Prada revealed a jewellery collection in October featuring diamonds grown in the shape of its triangle logo. The month before, Fred introduced blue-hued diamonds crafted to reflect the play of sunlight on the sea. TAG Heuer debuted its first timepiece with lab-grown stones in 2022 and has since introduced novel variations, including one studded with yellow diamonds this January.

The limited number and size of these efforts show luxury still isn’t ready to trade mined diamonds for man-made ones at a large scale, even as more accessible parts of the jewellery market have fully embraced them. (Swiss watch brand Breitling, which said in 2022 that it would phase out natural stones, has proved an outlier.) Rather, in each of these cases, the companies turned to lab-grown gems because they offered creative freedom that would be more costly, more time-consuming and generally more difficult — if not impossible — to achieve with their natural counterparts.

LVMH, for example, said it would have been extraordinarily difficult to secure enough natural diamonds with the specific colour and clarity of Fred’s lab-grown “Audacious Blue” diamonds.

ADVERTISEMENT

Beyond their brilliance, the value of natural diamonds has always stemmed from their rarity. It can require excavating huge amounts of ore to locate gem-quality stones with the colour and clarity brands seek. To obtain a flawless one-carat colourless diamond, for instance, can mean mining 100,000 tonnes (about 220.5 million pounds) of ore, according to the Gemological Institute of America (GIA).

A lab, however, can grow a diamond to a brand’s specifications.

“With lab-grown, it’s a complete paradigm shift in how one designs and what is possible,” said Christopher Griffin, co-founder and chief executive of Snow, the diamond start-up that supplied Prada with its lab-grown stones last year and which is speaking publicly for the first time. “Instead of starting with this inventory constraint and then trying to design around that, the jewellery designer can start with their imagination.”

At the same time, the quality of man-made stones has improved greatly, making them fit for use by even top-tier jewellers if they choose. Much of the progress is due to advances in technology and control over the growing process, said Ulrika D’Haenens-Johansson, a GIA research scientist.

What’s driving luxury’s reluctance, though, is less the quality of the stones than the prestige and storytelling — or lack thereof — around them. Even if they’re chemically the same, something grown in a lab with seemingly endless capacity has less allure than a precious material formed deep in the earth hundreds of millions to billions of years ago, a talking point promoted by trade groups lobbying for natural diamonds. But some brands and producers are trying to tell a new story.

Snow was founded in late 2017 and remained in stealth mode until now as it developed its technology and made sure to find the right partner to showcase it. Griffin said it’s working with other jewellery and luxury partners beyond Prada but wasn’t yet able to disclose which ones.

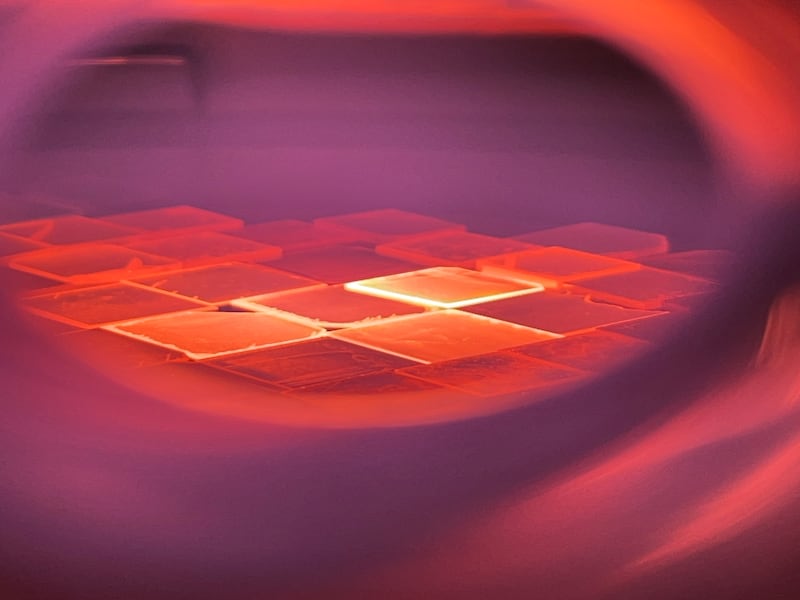

The company is among those to have built its own proprietary chemical vapour deposition reactors. CVD works by pumping a mix of gases into a vacuum chamber and superheating them — reaching temperatures as high as the surface of the sun in some cases — causing the chemical bonds to break down. Carbon atoms fall out of the plasma cloud like snowflakes and collect on a seed crystal, such as a tiny wafer of natural diamond. (Snow chose its name because of the similarity to snowflakes accumulating.) Over time enough carbon gathers to form a rough stone.

Though the first CVD-made diamonds only hit the gem market about a decade ago, some 80 percent of the lab-grown diamonds GIA sees now are produced with the technique. (The other common method involves compressing carbon at high pressure and temperature.) Originally it was used for other materials, such as those found in semiconductors. But more companies have been turning to it for diamonds, and as the market for jewellery featuring lab-grown diamonds has boomed, companies such as South Carolina-based Adamas and Israel’s Lusix, which received an investment from LVMH’s venture arm in 2022, have developed proprietary processes focused on producing gem-quality stones.

ADVERTISEMENT

“Oftentimes the highest quality material is coming from companies that have either created their own systems or modified existing systems,” D’Haenens-Johansson said.

Snow created its own reactors and gas mixture, which Griffin compared to its own secret Coca-Cola recipe, with the goal of producing high-quality diamonds at scale and with as little variance in quality as possible in order to appeal to luxury jewellers looking for a reliable source of lab-grown stones. He wants the company to be not just a supplier but a platform for brands to explore new creative techniques with diamonds.

“We are developing all kinds of new tools that will allow new creative ways of designing and cutting stones and polishing them into totally new shapes,” he said.

In his view, Prada’s work with Snow was a testament to the possibilities lab-grown diamonds offer high-end jewellery brands, which can be reluctant to experiment with new cuts and shapes when dealing with limited and extremely expensive raw materials.

Prada, which declined to comment, is arguably different from historic jewellers such as Van Cleef & Arpels or Harry Winston. It only introduced fine jewellery in late 2022 and deliberately took a different approach, focusing on sustainability and using only recycled gold.

“We couldn’t just jump in and do a line of jewellery like other brands — we had to think about how we could be disruptive,” Lorenzo Bertelli, Prada’s head of corporate social responsibility, told the New York Times at the time.

Lab-grown stones are already common in more accessibly priced jewellery. Investment bank Bernstein noted that they’ve taken about 50 percent of the bridal market, while overall sales keep rising. They’re on track to reach $18 billion in 2024, according to diamond-industry analyst Paul Zimnisky — a quarter of the $72 billion forecast for natural diamonds and far above their $1 billion in sales just under a decade ago. Part of what’s driving the growth is the widespread advances in quality.

“It’s actually turning into what I would almost describe as a run-of-the-mill manufacturing industry,” Zimnisky said. “We went from a situation 10 years ago where there weren’t a whole lot of companies that could effectively produce high-quality gemstones — fast forward to today and there’s quite a bit of companies that are able to do that.”

ADVERTISEMENT

Prices have come down as the technology has improved and producers build out more capacity, reaching greater economies of scale. The cost of natural diamonds, by contrast, has remained far more stable.

But for luxury brands that thrive on scarcity and storytelling, these dynamics are an obstacle to using man-made gems. Zimnisky pointed out that jewellery is an emotional, discretionary purchase, not a practical one — and not just about buying the cheapest item. It’s harder to weave a story around a product made in a lab, as Cartier CEO Cyrille Vigneron suggested when he told BoF in 2021, “The problem with lab-grown diamonds is that, despite having the same molecular structure as those found in the earth, lab-grown diamonds don’t have any [history].”

The narrative around natural diamonds has its own shortcomings, of course, with stories of human-rights abuses and blood diamonds. Breitling’s decision to adopt man-made stones was based on sustainability, though there are questions about the carbon footprints of lab-grown gems, which are energy-intensive to produce and mostly made in India and China where coal powers much of the industry.

Snow’s Griffin said the associations mined diamonds have of signalling status — social and relationship — are increasingly “out of step with where the zeitgeist is.” Lab-grown diamonds could open a new world of associations with innovative design, creativity and even craftsmanship, he added. Rather than just being cut and polished, every aspect of them is consciously crafted, including their size, shape and colour.

Whether luxury brands ultimately get on board depends on whether they buy that story, and whether they can sell it.

Disclosure: LVMH is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholders’ documentation guaranteeing BoF’s complete editorial independence.

Consumers — and the industry — are increasingly buying into lab-grown stones, altering long-held jewellery industry standards for how diamonds are sold.

Synthetic stones now make up 10 percent of the diamond market, highlighting the ways in which new materials are rewriting the rules of what is considered luxury.

Brands selling synthetic stones should make their provenance clear in marketing, according to the UK’s Advertising Standards Authority.

Marc Bain is Technology Correspondent at The Business of Fashion. He is based in New York and drives BoF’s coverage of technology and innovation, from start-ups to Big Tech.

Brands are using them for design tasks, in their marketing, on their e-commerce sites and in augmented-reality experiences such as virtual try-on, with more applications still emerging.

Social networks are being blamed for the worrying decline in young people’s mental health. Brands may not think about the matter much, but they’re part of the content stream that keeps them hooked.

After the bag initially proved popular with Gen-Z consumers, the brand used a mix of hard numbers and qualitative data – including “shopalongs” with young customers – to make the most of its accessory’s viral moment.

At The Business of Fashion’s Professional Summit in New York last week, Sona Abaryan, partner and global retail and luxury sector lead at tech-enabled data science firm Ekimetrics, shared how businesses can more effectively leverage AI-driven insights on consumer behaviour to achieve a customer-centric strategic approach.