The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

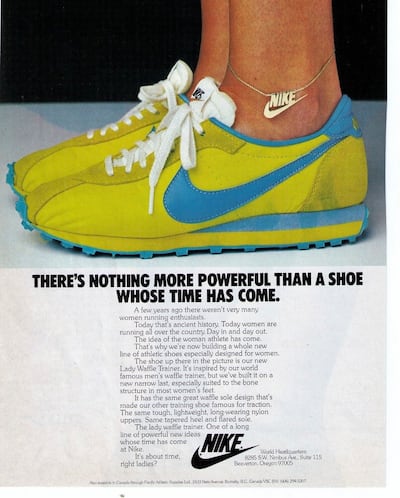

“The idea of the woman athlete has come,” declared a 1977 Nike ad promoting the launch of its Lady Waffle running sneaker.

It was a bold announcement for a shoe nearly identical to the original male version, save for a narrower shape. Unfortunately, in terms of innovation in women’s athletic footwear, sneaker brands have made only halting progress — up until recently.

For decades, the norm in women’s sneakers has been for brands to create near-carbon copies of men’s shoes simply dressed up in brighter colourways and offered in smaller sizes. A lack of scientific research into the particular needs of female athletes has meant there is sparse data from which brands can draw in developing footwear for women.

But in recent years, new studies have emerged shedding light on the topic, spreading awareness around differences between the male and the female anatomy that impact performance, such as the greater joint motion experienced by women which can lead to increased physical stress on knees and ankles.

ADVERTISEMENT

Earlier this year, a Sky Sports investigation found that professional sportswomen are up to six times more likely to suffer ACL injuries — a rupture of the anterior cruciate ligament in the knee which requires a year-long rehabilitation — than their male counterparts. US soccer legend Megan Rapinoe, for example, has suffered three in her career.

Today, a small but growing cohort of sneaker start-ups are addressing exactly these issues, designing performance shoes that cater exclusively to women with features such as lower heel cups that reduce pressure on the Achilles, better support for the arches of female feet and other functions that mitigate movement in the shoe to better secure joints upon impact.

This group includes Hettas, a Vancouver-based women’s running sneaker brand that quietly launched in November; Moolah Kicks, a basketball footwear company founded in New York in 2020; Saysh, the sportswear label by US Olympian Allyson Felix; and IDA, a UK-based brand that creates football boots for women.

“When we looked at the prior research in this area, no one was asking: ‘How do you design a better shoe based on anatomical differences?’” said Lindsay Housman, co-founder and chief executive of Hettas, which partnered with the biomechanics laboratory at Simon Fraser University to fund two research projects whilst working on the prototypes for its Alma sneaker line.

Hettas and its counterparts are vying to grab market share in the booming athletic footwear market, which today is largely driven by sales of running and training sneakers, generating sales of $73.9 billion in 2023, up 8 percent year-on-year, according to Euromonitor data. Between 2023 and 2026, sales of performance footwear are projected to grow at an average annual rate of 7.4 percent.

More established names have followed suit. Lululemon released several women’s-specific sneakers when it launched footwear in 2022, while others have unveiled running and basketball options designed for women in recent years, such as the Puma Run XX Nitro and Under Armour’s Breakthru model.

“Bigger brands are catching on because there’s more attention on women’s professional sports right now, and more data available on why there’s a need for this kind of footwear,” said Jessica Ramirez, senior research analyst at Jane Hali and Associates.

Moolah Kicks founder Natalie White was a manager of her college basketball team when she first noticed the gap in the market: the sneakers in an ad featuring four WNBA players were all named after male athletes in the NBA.

ADVERTISEMENT

“I quickly learned that the differences between the female and male foot form means that when we play in these men’s sneakers that are labelled unisex or children’s, we are more at risk for knee, ankle and leg injuries that are so common in women’s basketball,” said White, a lifelong club basketball player.

Men’s basketball shoes are typically large, wide and clunky, putting women’s knees and ankles at risk due to a lack of security for the foot. When White launched her brand in 2020, it became the first position-specific basketball shoe designed exclusively for women, including low-top sneakers for guards, and high-tops for centres and forwards.

Hettas’ walking, running and training shoes address similar pain points for female runners, whose narrow heels compared to their male counterparts exacerbates strain on the Achilles tendon. A rounded instep, meanwhile, better matches the curved shape of a woman’s foot and a proprietary two-layered foam midsole is designed to help cushion women’s lighter step.

UK-based start-up IDA was set up by entrepreneur Laura Youngson in 2018 to address the same issues in football. Like in basketball, larger brands have largely ignored the need for football boots designed specifically for women, despite the prevalence of ACL injuries in the sport (30 players missed out on last summer’s Women’s World Cup because of it). IDA’s boots are made with a wider toe box, shorter studs, a pronounced arch support and a narrower heel cup, to reduce movement of the foot inside the shoe while an athlete is running or jumping, providing better security for the knee and ankle joints.

So far, growth has been steady for the likes of IDA and Hettas — though not as explosive as their unisex counterparts like On and Hoka.

Investors have been harder to convince in a market where consumers already have hundreds of compelling brands to choose from — even if they don’t cater specifically to women, according to Hettas’ Housman.

Without major backers (Hettas raised a friends and family round in 2022 and a further bridge round last year), Hettas is pursuing more organic routes for expansion, such as reaching out to local running clubs and professional athletes, as well as developing relationships with specialty running retailers in Canada.

Hettas is set to expand into the US through a deal with Forward Motion Sports, an outdoor sports store in north California, while the brand also plans to target the avid running community in Brooklyn.

ADVERTISEMENT

Growth has come a lot quicker for Moolah Kicks, which has benefitted from an explosion in popularity in women’s basketball in recent years, said White.

In the last four years, we went from an idea to the leading brand in a category that we created ourselves.

Today, Moolah Kicks is carried in 570 Dick’s Sporting Goods stores, up from 140 in 2021. In recent years, the brand has launched new products including a $124 multi-purpose Neovolt Pro sneaker along with a children’s collection and a performance apparel line. It is also growing awareness through an extensive partnerships programme with college athletes across the US and a roster of over 100 Amateur Athletic Union partner teams whose players wear Moolah sneakers and apparel. The brand also has shown up on court in the WNBA thanks to deals with Courtney Williams of the Minnesota Lynx and Destanni Henderson, who now plays overseas.

While larger sportswear brands like Adidas, Puma and Under Armour have jumped on the bandwagon for women-specific performance shoes, it’s still the upstarts like Moolah that carved out their own space in the market — and continue to lead the pack on innovation.

“In the last four years, we went from an idea to the leading brand in a category that we created ourselves,” White said.

On hasn’t taken long to turn its unconventional performance-running shoes into one of the world’s most recognisable footwear brands. The Swiss company, launched in 2010, has won credibility with the running elite while cultivating a loyal fashion fanbase, with support from tennis star Roger Federer.

Nike is experiencing its worst slump in a decade, even as its competitors thrive. Insiders, athletes and fans pin the blame on changes made over the last few years that led to stalling innovation, disruptive restructurings and uninspired marketing.

Breaking into the $384 billion sports apparel market is no easy task, but fast-growing start-ups are stealing market share by creating specialised, fashion-forward products around underserved interests.

Daniel-Yaw Miller is Senior Editorial Associate at The Business of Fashion. He is based in London and covers menswear, streetwear and sport.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.

Manhattanites had little love for the $25 billion megaproject when it opened five years ago (the pandemic lockdowns didn't help, either). But a constantly shifting mix of stores, restaurants and experiences is now drawing large numbers of both locals and tourists.