The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

On Sunday, Puig filed to go public in Spain, betting that an infusion of capital and the “checks and balances” of a listed company structure will unlock the next phase of growth at the fragrance and cosmetics giant.

In fashion, many brands and retailers are coming to the opposite conclusion.

This week also saw Macy’s end its proxy fight with activist investor Arkhouse Management, appointing two of its slate of nominees to the department store operator’s board. The new directors will sit on a committee to evaluate the $6.6 billion takeover bid from Arkhouse and Brigade Capital.

Macy’s wasn’t the only company contemplating going private. Austrian billionaire Reinold Geiger is reportedly lining up potential lenders and investors, including the private equity giant Blackstone, to acquire L’Occitane (Geiger is already the beauty conglomerate’s controlling shareholder).

ADVERTISEMENT

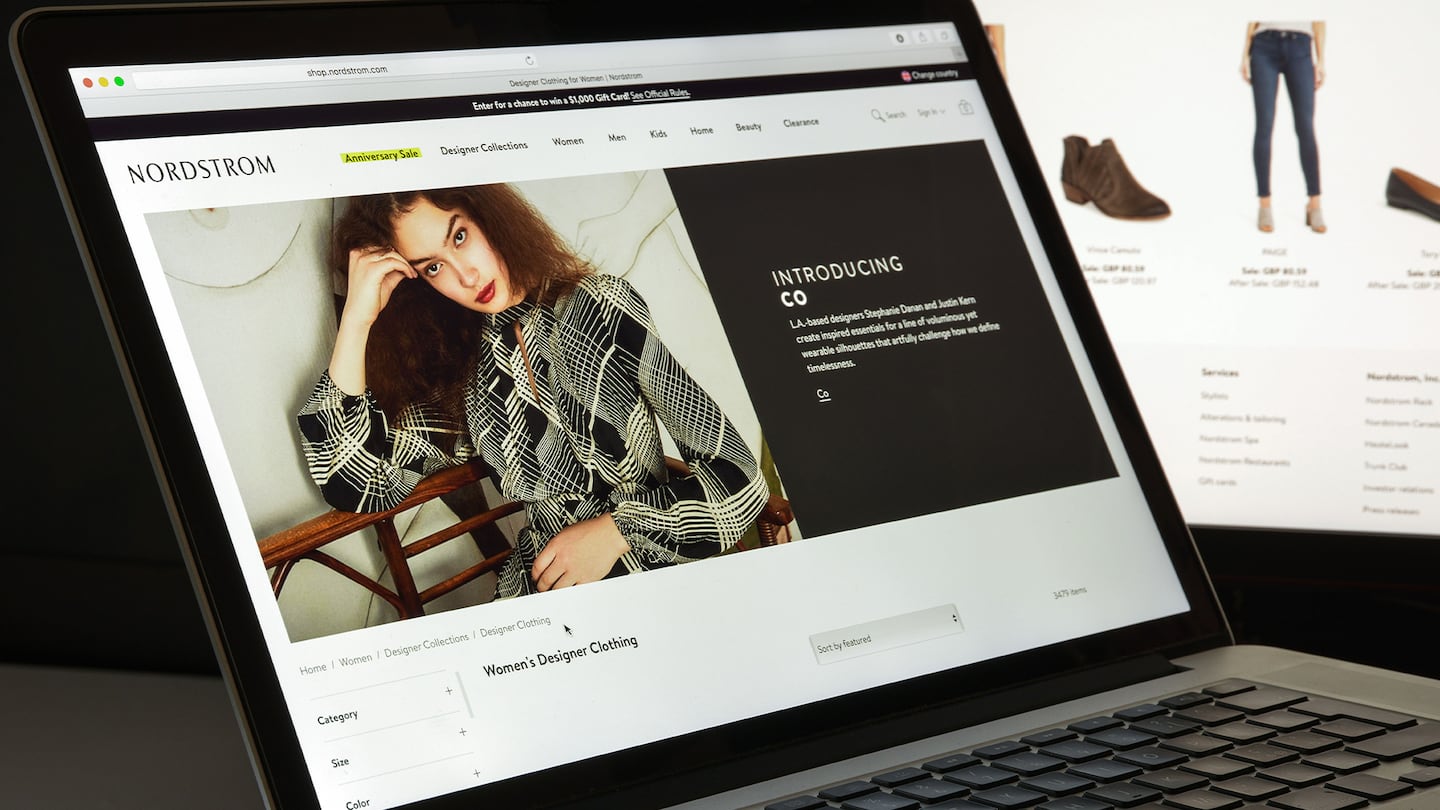

There’s more: The Nordstrom family is reportedly mulling taking its namesake department store chain private. Italian shoemaker Tod’s is planning to delist from the Italian stock exchange, eliciting the help of L Catterton, LVMH’s investment arm, which agreed to buy 36 percent of Tod’s shares in February. Struggling direct-to-consumer brands like Allbirds, which recently received a notice from Nasdaq that it would be delisted if it can’t raise its share price, are among other potential takeover targets.

The circumstances are different at each of these companies. But the motivation for going private is often the same: a belief that it will be easier to turn around a struggling business away from the scrutiny of the public market. Tod’s owners said in a statement in February that going private would grant the company “greater management and organisational flexibility, with faster decision-making and execution times.”

There’s some truth to that. Turning around a fashion business requires commitment, patience and finesse, qualities that few investors possess. For a public company, a couple disappointing quarters can derail a meticulously planned five-year strategy. Family-controlled companies think in terms of generations, not quarters (at least until the heirs get antsy for a payday). Rather than cashing out when the going gets tough, these owners have the type of vested interest in the long-term success of their companies necessary for gruelling, high-risk turnarounds.

The ultimate example of this line of thinking is Levi’s. The American denim brand went public in 1971, but during a challenging period in the mid-1980s was taken private again in a leveraged buyout that gave control back to the Haas family, descendants of founder Levi Strauss. As a private company, Levi’s steadily scaled, and three decades later, the Haas family were able to cash out their shares in an $8 billion IPO.

But there’s a reason we’re reaching back to the 1980s to find an unqualified success story. There are plenty of downsides to going private. Leveraged buyouts, by definition, saddle a company with a mountain of debt. Look at what happened to J.Crew and Neiman Marcus, both of which went through a lost decade after being acquired by private equity firms in the aughts and 2010s. Both filed for bankruptcy in 2020, though they seem to be on better footing today under the ownership of their former creditors.

A public company, by contrast, can be pressured into jettisoning bad management and operating at peak efficiency; Abercrombie & Fitch is one recent example.

Like Sears’ hedge fund owner, Eddie Lampert, Macy’s prospective buyers may not be interested in reviving a storied name at all. Its current pursuers, Arkhouse Management and Brigade Capital, have a history in real estate, not retail. It’s widely assumed that their priority is to monetise the company’s real estate; what that means for the current revamp under chief executive Tony Spring, who assumed the top role just two months ago, is unclear.

Ultimately, going private won’t solve the problems facing Macy’s, Nordstrom, Allbirds or L’Occitane. But for some at least, it may be the best chance they have.

ADVERTISEMENT

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

Macy’s appoints two new directors ending a proxy contest with Arkhouse. The appointments of Richard Clark and Richard Markee as independent directors also resulted in Arkhouse withdrawing its board nominees. They will join the board’s finance committee, which in addition to its existing responsibilities, will oversee the evaluation of the proposal from Arkhouse and Brigade.

Allbirds receives a six month notice to raise its stock price. The embattled sneaker must trade at more than $1 for at least 10 consecutive days or risk being delisted. Allbirds’ share price has plummeted more than 90 percent since its IPO in November 2021.

Chanel eyes NYC Fifth Avenue tower that LVMH is also targeting. Chanel is in discussions to buy 745 Fifth Ave, joining the competition among the world’s top retailers to snap up spots on New York’s iconic luxury shopping corridor. LVMH Moët Hennessy Louis Vuitton SE has also been in talks to acquire the building at the corner of 58th Street.

Rent the Runway eyes record jump as earnings spark revival hope. The stock surged as much as 226 percent in intraday trading Thursday after the company reported fourth-quarter revenue and adjusted earnings that beat Wall Street expectations. The quarterly report was a breath of fresh air for the company after investors had mostly given up on it.

Nike pins hopes on Olympics to win back market share. Nike unveiled Olympic kits for the teams it sponsors on Thursday alongside athletes including Kenyan marathon star Eliud Kipchoge and British sprinter Dina Asher-Smith. The brand is hoping that Olympians breaking records in Nike gear could help push more shoppers to the label, which has seen slowed sales growth.

Korean fashion e-tailer Musinsa posts $733 million in annual revenue. EBITDA for the year surged 15.9 percent to $61.9 million from $53.4 million in 2022. Musinsa’s net profit reached $26.2 million from a net loss of $4.9 million in 2022.

ADVERTISEMENT

Zara owner Inditex demands clarity from cotton certifiers accused of standard breaches. NGO Earthsight informed the retailer that producers with Better Cotton certifications were involved in land grabbing, illegal deforestation and violent acts against local communities. Inditex sent a letter dated April 8 to Better Cotton CEO Alan McClay asking for clarity on the certification process and progress on traceability practices.

Fashion Trust US announces second round of winners. The two-year-old organisation selected fashion designer Batsheva Hay of Batsheva for its sustainability work; Charles Harbison of Harbison Studio was awarded the ready-to-wear award and Ashley Harris of Don’t Let Disco won a prize for inclusivity. Winners received grants that totalled at nearly $500,000 across the six awards.

Rolex CEO says comparing watches to stocks is dangerous. Secondary market watch prices have fallen sharply in the past two years amid weaker economic growth and higher interest rates. Jean-Frédéric Dufour said the strong value of the Swiss franc against other currencies is also adding to pressures on the industry.

THE BUSINESS OF BEAUTY

Puig aims to raise €2.5 billion in IPO. The family-owned premium beauty conglomerate has confirmed it will float shares on the Spanish stock exchange while retaining majority control. In 2023, Puig reported net revenues of €4.3 billion ($4.6 billion), up 19 percent, while net profit rose to €465 million ($503 million), up 16 percent on the previous year.

Blackstone nears buyout of skincare company L’Occitane. The world’s largest alternative asset manager may provide debt financing for the buyout. Trading of L’Occitane was suspended in Hong Kong on Tuesday, pending announcement related to takeover codes.

Neutrogena is closing its Los Angeles office and laying off staff. Closing the office is part of parent company Kenvue Inc.’s effort to boost growth and improve collaboration, according to a spokesperson for the company. The closure is resulting in 84 layoffs, 74 have been offered relocation and employment at other company locations.

Picky consumers jilting big brands are Unilever India’s new risk. India’s elite classes are becoming pickier consumers, fuelling the success of organic personal-care brands backed by slick social media marketing campaigns. The company’s challenges mirror those of other consumer-goods giants, such as Procter & Gamble Co., L’Oréal SA who have had to acquire the niche brands taking market share from their in-house businesses.

UK’s antitrust authority issues price-fixing warning to nail technicians. The Competition and Markets Authority has issued an open letter to nail technicians after a campaign called National Nail Tech Price Increase Day began to gain steam online. More than 5,000 technicians came together as part of the campaign to raise their prices on Monday.

CDC reportedly investigates several cases of illnesses from botox injections. Health officials in Tennessee and Illinois this week said they were investigating cases of botulism-like illnesses that appeared connected to Botox injections received in a non-medical setting. There were four patients in Tennessee who reported symptoms that aligned with botulism after receiving cosmetic injections and two were hospitalised.

PEOPLE

Gucci hires deputy CEO to bolster turnaround efforts. Stefano Cantino joins from Louis Vuitton, where he held the role of marketing chief and oversaw the brand’s sprawling communications apparatus. The appointment comes at a pivotal moment for Gucci as Kering attempts to revamp the brand’s image.

Salomon president and CEO Franco Fogliato steps down. Fogliato will depart the brand effective immediately due to personal reasons. James Zheng, Amer Sports’ chief executive, will lead Salomon on an interim basis, the company confirmed.

Louis Vuitton taps Wieden+Kennedy veteran to lead communications. Advertising executive Blake Harrop is set to join Louis Vuitton as executive vice president, image and communications. In his new role, Harrop “will enable us to reach new heights, further contributing to strengthening the desirability of Louis Vuitton,” chief executive Pietro Beccari said.

MEDIA AND TECHNOLOGY

Three films produced by Saint Laurent selected for Cannes Film Festival. The three films are: “Emilia Perez,” by Jacques Audiard, starring Zoe Saldana and Selena Gomez; David Cronenberg’s “The Shrouds,” starring Vincent Cassel; and “Parthenope,” directed by Paolo Sorrentino. The deciding jury will be chaired by Greta Gerwig.

Compiled by Yola Mzizi.

Editor’s note: This article was amended on 15 April, 2024. A previous version suggested Macy’s proxy fight was with two activist investors. This is incorrect; Macy’s most recent proxy fight was against just one investment firm, Arkhouse Management.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.

Manhattanites had little love for the $25 billion megaproject when it opened five years ago (the pandemic lockdowns didn't help, either). But a constantly shifting mix of stores, restaurants and experiences is now drawing large numbers of both locals and tourists.

BoF Careers provides essential sector insights for fashion professionals in retail this month, to help you decode fashion’s retail landscape.