The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

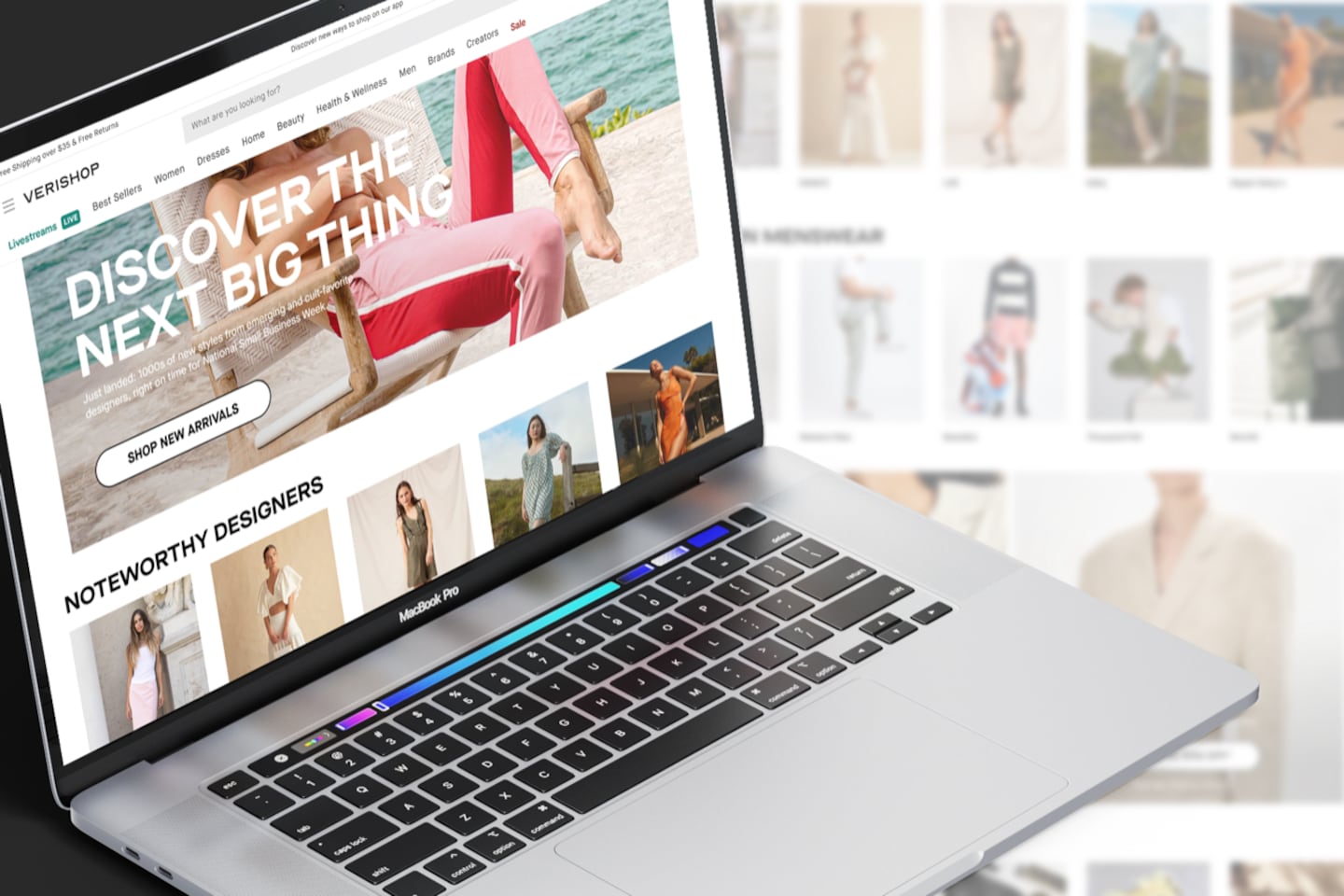

E-commerce marketplace Verishop bought data analytics firm Trendalytics in a cash and equity deal that closed in March, the company confirmed to Business of Fashion. Financial terms of the deal were not disclosed.

Trendalytics, which provides search and trend forecasting data to companies like Ulta and Macy’s, will give the small brands that sell on Verishop insights to help them curate their product selections to better cater to timely style trends. Verishop expects this to boost sales across all its brands as more consumers shop based on breakneck internet trends.

Trendalytics will remain a standalone business under the Verishop umbrella. The data platform was previously owned by brand incubator HatchBeauty Brands, which acquired it in 2021. Last year Trendalytics began discussions with Verishop, for which it shares an investor Lion Capital, after initially courting the marketplace as a potential client.

The acquisition is Verishop’s latest move to expand beyond its original marketplace model. The company, now called Verishop Group, also helps independent labels secure brand partnerships. The addition of Trendalytics will beef up Verishop’s marketing and merchandising data analytics services, as more brands seek better data to understand and respond to shifting consumer behaviour.

ADVERTISEMENT

“We see this as the ability for [brands] to make better decisions around marketing, planning [and] product development,” said Cate Khan, co-founder and chief executive of Verishop Group. “Their success on our platform, and even off our platform, means higher engagement with Verishop Group and more sales. It’s feeding that flywheel so that we all can be successful together.”

Learn more:

Case Study | How to Turn Data Into Meaningful Customer Connections

Before fashion businesses can put artificial intelligence to work or target the right shoppers online, they need good data and a deep understanding of who their customers are and what they want. This case study offers a guide for brands that want to truly know their customer, allowing them to make smarter decisions that serve shoppers and drive results.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.

Manhattanites had little love for the $25 billion megaproject when it opened five years ago (the pandemic lockdowns didn't help, either). But a constantly shifting mix of stores, restaurants and experiences is now drawing large numbers of both locals and tourists.