The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This report was created in partnership with Royalmount, the forthcoming luxury shopping district in the heart of Montreal by real estate developer Carbonleo.

Luxury shopping is at an inflection point. Today, luxury fashion shoppers not only want superior customer service and access to the highest-quality brands in-store as they always have, they now expect brands and retailers to deliver in engaging ways while embracing the latest advances in sustainability and technology, according to a new BoF Insights report.

A tall order perhaps, but best-in-class luxury players have strategies in play to meet these higher expectations as the report, titled “The Evolving Art of Luxury Experiential Retail,” demonstrates. BoF Insights, in partnership with Royalmount, conducted a survey of approximately 1,500 shoppers in the US and Canada for the report along with interviews of senior executives from across the retail industry to understand best practices and what lies ahead for luxury experiential shopping.

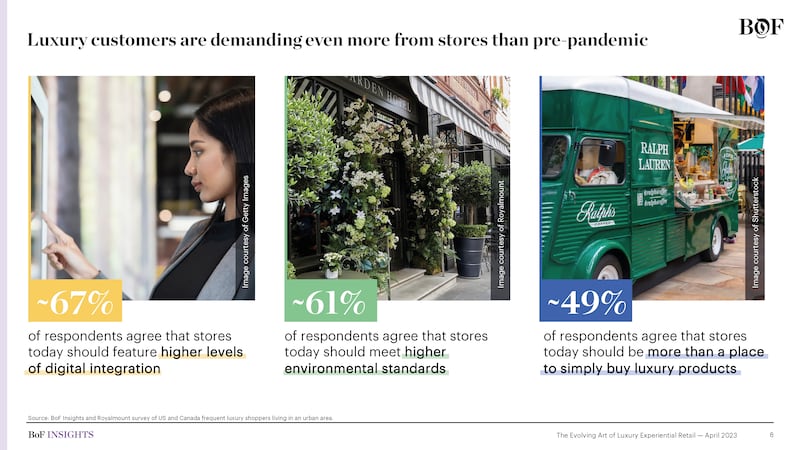

To meet — and exceed — customer expectations, brands and retailers must raise the bar by innovating around three key pillars: “supercharged connectivity,” or innovative technology that facilitates deeper human relationships; “sustainable retail” both inside and outside stores; and “inclusive luxury,” which creates engaging retail spaces that can offer something to all visitors. For example, nearly half of frequent luxury consumers in North America surveyed for the report agree that luxury stores should be more than a place to purchase products, while nearly two-thirds expect sustainability to be an important feature in their shopping experience.

Even as e-commerce plays an important role in consumer behaviour, another key finding is that stores are still paramount. About 77 percent of frequent luxury customers from the survey say they expect to visit a store as often or even more frequently in the year ahead than in 2022. Stores are thus pivotal for brand communities, customer service and storytelling.

Luxury retail must be redefined by embedding immersive and emotional experiences. The report’s seven case studies illustrate how varied companies at the forefront are moving the needle on experiential retail: Harrods, Le Bon Marché, Nike, Reformation, RH and Sephora, along with a study of Royalmount, a mixed-use luxury shopping destination from Carbonleo, with the first phase set to open in 2024.

To learn more about the Royalmount project, please click here.

This is a sponsored report paid for by Royalmount as part of a BoF partnership.

Royalmount is a forthcoming mixed-use shopping district in Montreal oriented around sustainability, inclusivity and connectivity; in a new partnership with Royalmount, BoF Insights will explore how such developments could set the standard for physical retail of the future.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.

Manhattanites had little love for the $25 billion megaproject when it opened five years ago (the pandemic lockdowns didn't help, either). But a constantly shifting mix of stores, restaurants and experiences is now drawing large numbers of both locals and tourists.